Strategy CEO: Bitcoin would need to crash to 8,000 and stay years before balance-sheet risk

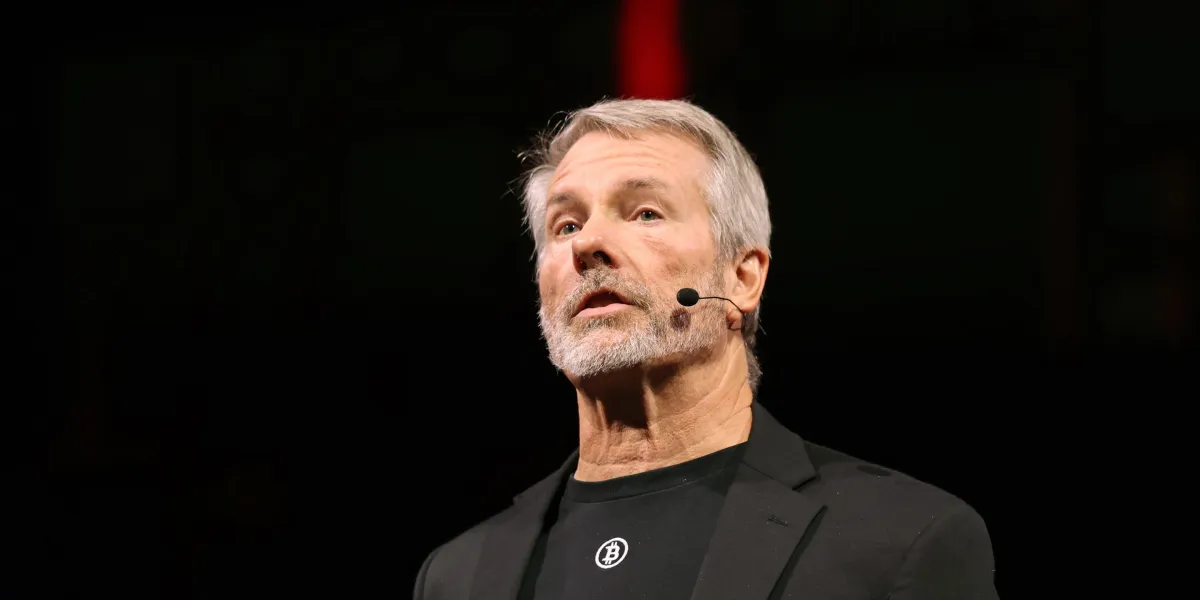

Strategy CEO Phong Le said the balance sheet is safe unless Bitcoin falls to about $8,000 and remains there for five to six years; the company posted a $12.6 billion quarterly net loss from unrealized BTC losses as Bitcoin traded around $64,800, while Michael Saylor dismissed quantum-threat concerns as 'horrible FUD' and announced a Bitcoin Security program to bolster resilience amid the crypto sell-off.