Citadel Securities predicts strong stock inflow in January

Citadel Securities predicts significant inflows of big money into stocks this January, highlighting the January effect as a key market trend for the month.

All articles tagged with #january effect

Citadel Securities predicts significant inflows of big money into stocks this January, highlighting the January effect as a key market trend for the month.

Historical analysis from Bespoke Investment Group suggests that if the S&P 500 finishes January in positive territory, it is likely to continue climbing for the rest of the year, with a median performance gain of 13.5% and positive returns 84% of the time. Conversely, if the index finishes January with weaker gains or in the red, its prospects for the rest of the year are less favorable, with a median performance gain of 6.4% and positive returns 68% of the time. As of now, the S&P 500 has gained 2.5% since the beginning of January, but was on track to finish lower at the end of the week.

Despite a strong rally in U.S. stocks at the end of 2023, concerns are emerging about a potential market downturn in early 2024, challenging the traditional "January effect." Factors such as overbought conditions, a shift from bearish to bullish investor sentiment, low volatility levels, uncertainty around inflation data, and the potential for disappointing earnings could interrupt the stock market rally. Additionally, geopolitical events and political developments, along with expectations of Federal Reserve rate cuts already priced into the market, may also pose risks to the continued advance of U.S. equity indexes.

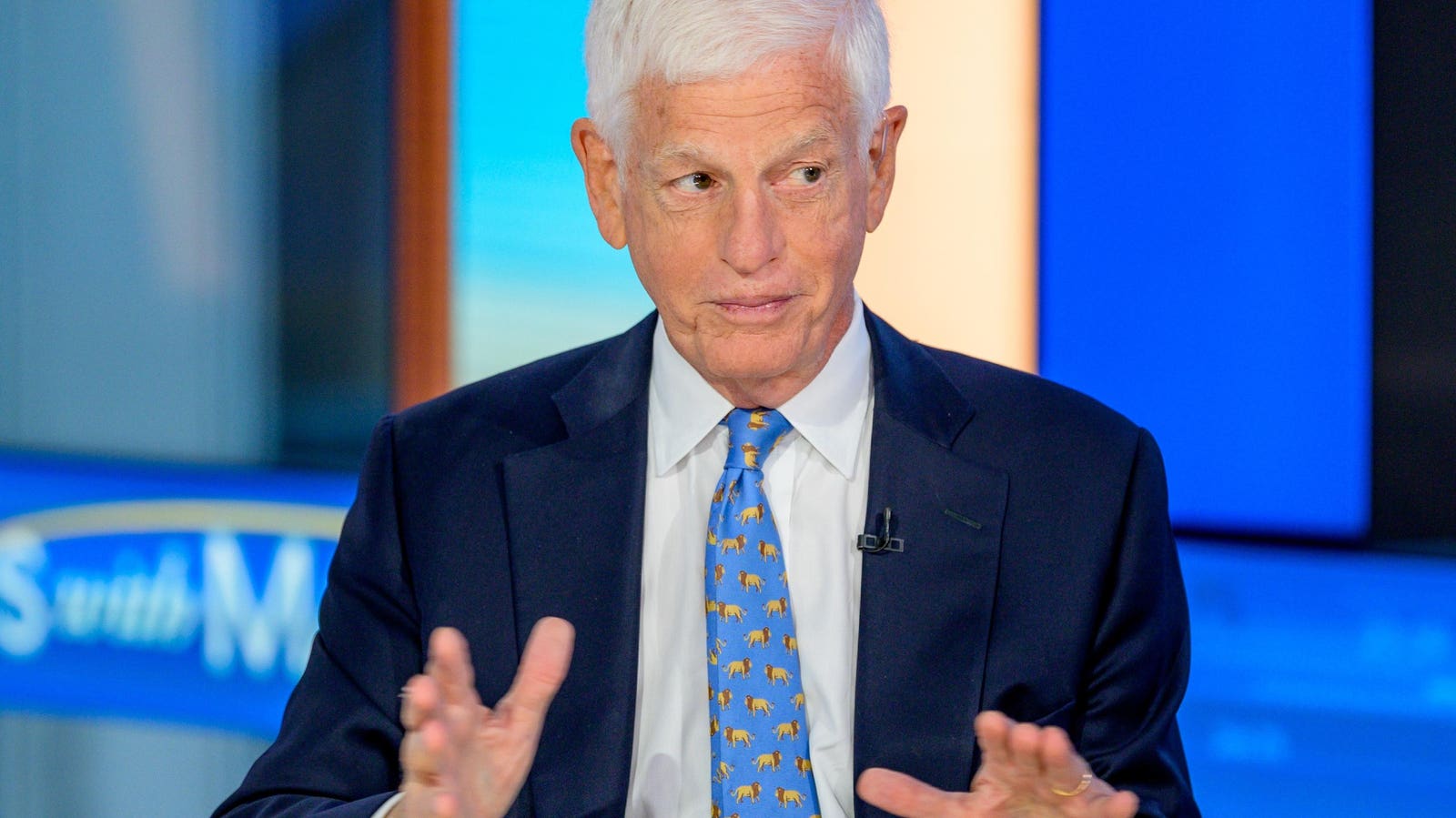

Billionaire investors like Mario Gabelli are eyeing smaller stocks for potential gains in the new year, despite the mixed historical performance of the January effect. While tax-loss harvesting and window-dressing may contribute to the January buoyancy, other factors such as political advertising and macroeconomic developments can also impact small-cap stocks. Some small caps that have caught the attention of billionaire investors include Sinclair, Grupo Televisa, Tredegar, Lindsay Corp, and Utz Brands. These stocks show potential for outsized returns in 2024 based on their relative strength, discounted valuations, and market opportunities.

The month of December presents a great opportunity to buy stocks, with several reasons to do so before January. While the January Effect, where stocks tend to rise in the first month of the year, may not be as reliable as in the past, there are still many buying opportunities available. Stocks like Amazon, CRISPR Therapeutics, and Etsy offer attractive valuations and growth potential. Additionally, buying before the ex-dividend date can be advantageous for dividend players. December is also a good time to review company news and earnings reports, providing insights into potential winners for the coming year. Seizing the day and taking advantage of current opportunities can lead to long-term gains in the market.