Citadel Securities predicts strong stock inflow in January

Citadel Securities predicts significant inflows of big money into stocks this January, highlighting the January effect as a key market trend for the month.

All articles tagged with #citadel securities

Citadel Securities predicts significant inflows of big money into stocks this January, highlighting the January effect as a key market trend for the month.

Kairan Quazi, a 16-year-old who graduated college at 14 and worked at SpaceX, has chosen to join Citadel Securities as a quant developer, valuing the firm's meritocratic culture and fast-paced environment over offers from AI labs and big tech, marking a notable shift from tech to finance for a young prodigy.

Citadel Securities' President Jim Esposito warns that the US deficit is a 'ticking time bomb' with potential to cause economic instability, while the firm plans to expand its cryptocurrency trading amid market volatility and sees significant growth opportunities internationally.

Citadel Securities has hired Herb Sutter, a C++ expert from Microsoft, to lead its C++ training initiatives. Sutter, recognized as a leading figure in the C++ community, will help Citadel's engineers and researchers enhance their proficiency in the language, which is crucial for the firm's trading systems. This move aims to improve system speed and reduce coding errors as Citadel expands into new markets. C++ is vital for high-frequency trading due to its low-level control over hardware and memory, offering speed advantages in competitive trading environments.

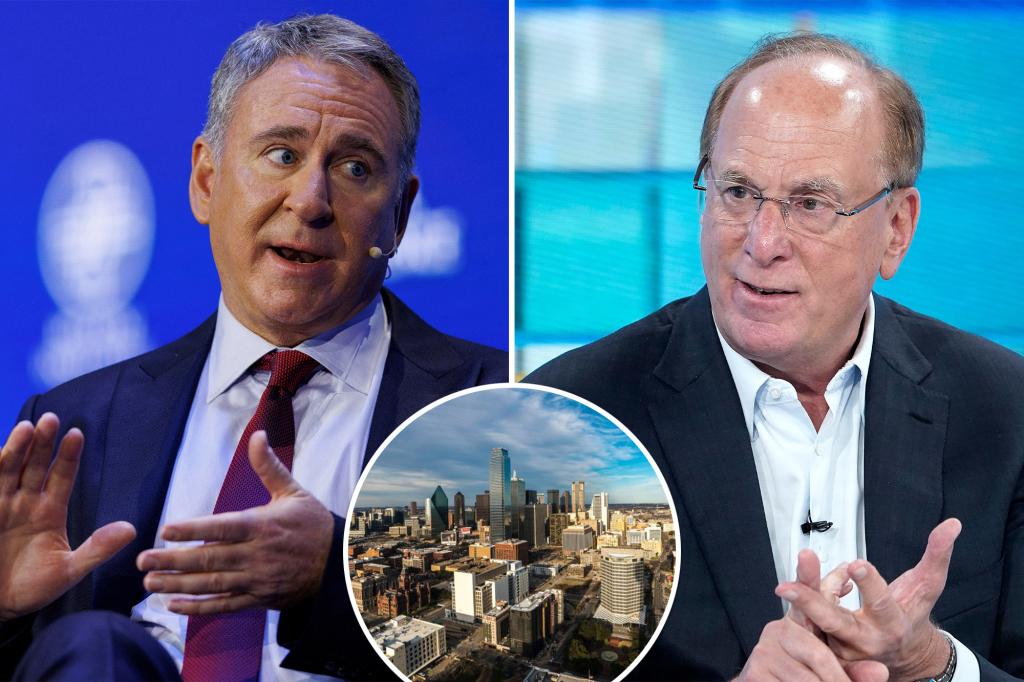

A consortium of financial firms, including BlackRock and Citadel Securities, plans to launch the Texas Stock Exchange in Dallas, offering an alternative to the NYSE and Nasdaq. They have raised $120 million and are seeking SEC approval to operate as a national securities exchange. The new exchange aims to be more CEO-friendly and capitalize on Texas's rapid economic growth.

BlackRock and Citadel Securities are backing the Texas Stock Exchange (TXSE), a new Dallas-based bourse aiming to challenge the New York Stock Exchange and Nasdaq. TXSE, which has raised $120 million, plans to file with the SEC to operate as a national securities exchange and hopes to start trading next year. The exchange seeks to attract global companies and reduce compliance costs associated with New York-based indexes. Texas has become a major financial hub, attracting numerous Fortune 500 companies and significant investments from firms like Apple and Goldman Sachs.

The Texas Stock Exchange (TXSE), headquartered in Dallas, is set to launch to compete with the NYSE and Nasdaq, backed by $120 million from investors including BlackRock and Citadel Securities. TXSE aims to start trading next year and host its first listing in 2026, leveraging Texas' business-friendly environment to attract companies. However, skeptics doubt its ability to challenge the established exchanges.

A group backed by BlackRock and Citadel Securities plans to launch the Texas Stock Exchange, aiming to compete with Nasdaq and NYSE by 2025. The exchange, which has raised $120 million, will file registration documents with the SEC later this year and seeks to attract listings of exchange-traded products while addressing compliance costs and diversity rules.

The CEO of Donald Trump’s social media company, Trump Media & Technology Group (TMTG), was criticized by Citadel Securities, a firm owned by billionaire Republican donor Ken Griffin, as a "proverbial loser" attempting to shift blame for the company's stock market struggles. Devin Nunes, the CEO of TMTG, had accused large trading firms, including Citadel Securities, of potential market manipulation. TMTG retaliated, accusing Citadel of harming small investors. Nunes claimed that "naked" short-selling was behind the stock market turbulence, prompting a response from Citadel. TMTG's stock rallied 9.6% on Friday amidst the ongoing dispute.

Ken Griffin's Citadel Securities and Devin Nunes, CEO of Truth Social's parent company, engaged in a war of words over accusations of stock manipulation and market manipulation. Nunes accused Citadel Securities and others of engaging in "naked short selling," prompting a response from Griffin's company calling Nunes a "proverbial loser." The feud stems from Trump Media and Technology Group's tanking stock price since going public, with Nunes sending a letter to Nasdaq accusing market makers of manipulation. The back-and-forth highlights the tensions surrounding the company's stock performance and the involvement of prominent figures in the finance and political spheres.

Citadel Securities criticized Trump Media CEO Devin Nunes for alleging possible illegal short selling in DJT shares and blaming the company for his falling stock price, prompting a response from Trump Media accusing Citadel Securities of corporate offenses. Nunes' letter to Nasdaq CEO Adena Friedman raised concerns about market manipulation and named Citadel Securities among other major market participants. The strong language in Citadel Securities' response is notable given the political ties between Trump Media and Citadel Securities, including donations from Citadel's founder Ken Griffin to Republican candidates, including Nunes.

Ant Group is competing with Citadel Securities in a bid to acquire Credit Suisse's China unit, as the Swiss bank seeks to offload the business amid a broader restructuring. The move reflects Ant Group's ambition to expand its financial services footprint in China, while Citadel Securities aims to strengthen its presence in the country's financial markets.

Citadel Securities, a Miami-based broker-dealer, has agreed to pay $7 million to settle charges brought by the U.S. Securities and Exchange Commission (SEC) for incorrectly handling millions of orders and violating short-selling rules. The SEC found that Citadel Securities had mistakenly marked short sales as long sales and vice versa due to a coding error in its automated trading system. The firm also provided incorrect data to regulators during this period. Citadel has agreed to pay the penalty, address the coding error, and review its programming and coding logic.

Citadel Securities, a broker-dealer, has settled charges with the Securities and Exchange Commission (SEC) for violating a provision of Regulation SHO, which requires marking sale orders as long, short, or short exempt. The SEC found that Citadel Securities incorrectly marked millions of orders over a five-year period due to a coding error in its automated trading system. The firm provided inaccurate data to regulators, including the SEC. As part of the settlement, Citadel Securities will pay a $7 million penalty and undertake remedial measures. Compliance with order marking requirements is crucial in curbing abusive market practices, such as naked short selling.

EDX Markets, a new crypto exchange backed by Fidelity Digital Assets, Charles Schwab and Citadel Securities, has launched in the US after building out its technology for the past nine months. The exchange only offers four tokens – bitcoin, ethereum, litecoin and Bitcoin Cash – partly because of the unclear regulatory landscape in the US. EDX Markets doesn't custody customers' digital assets, instead, users will have to go through financial intermediaries to buy and sell crypto assets, similar to how trades are executed on the New York Stock Exchange or the Nasdaq.