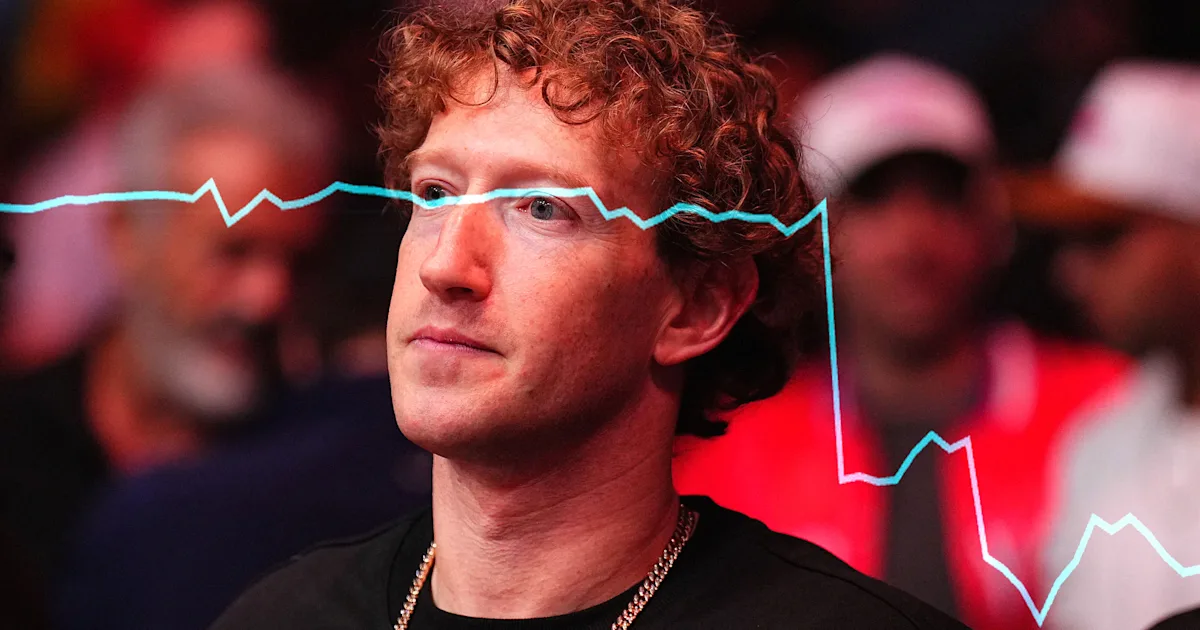

Meta Stock Dives Amid AI Spending Concerns and Tax Charges

Meta's aggressive AI investment of around $70 billion has caused its stock to drop over 11%, as investors worry about the lack of clear returns on the company's massive expenditures amid a broader industry trend of escalating AI investments by major tech firms like Microsoft and Alphabet.