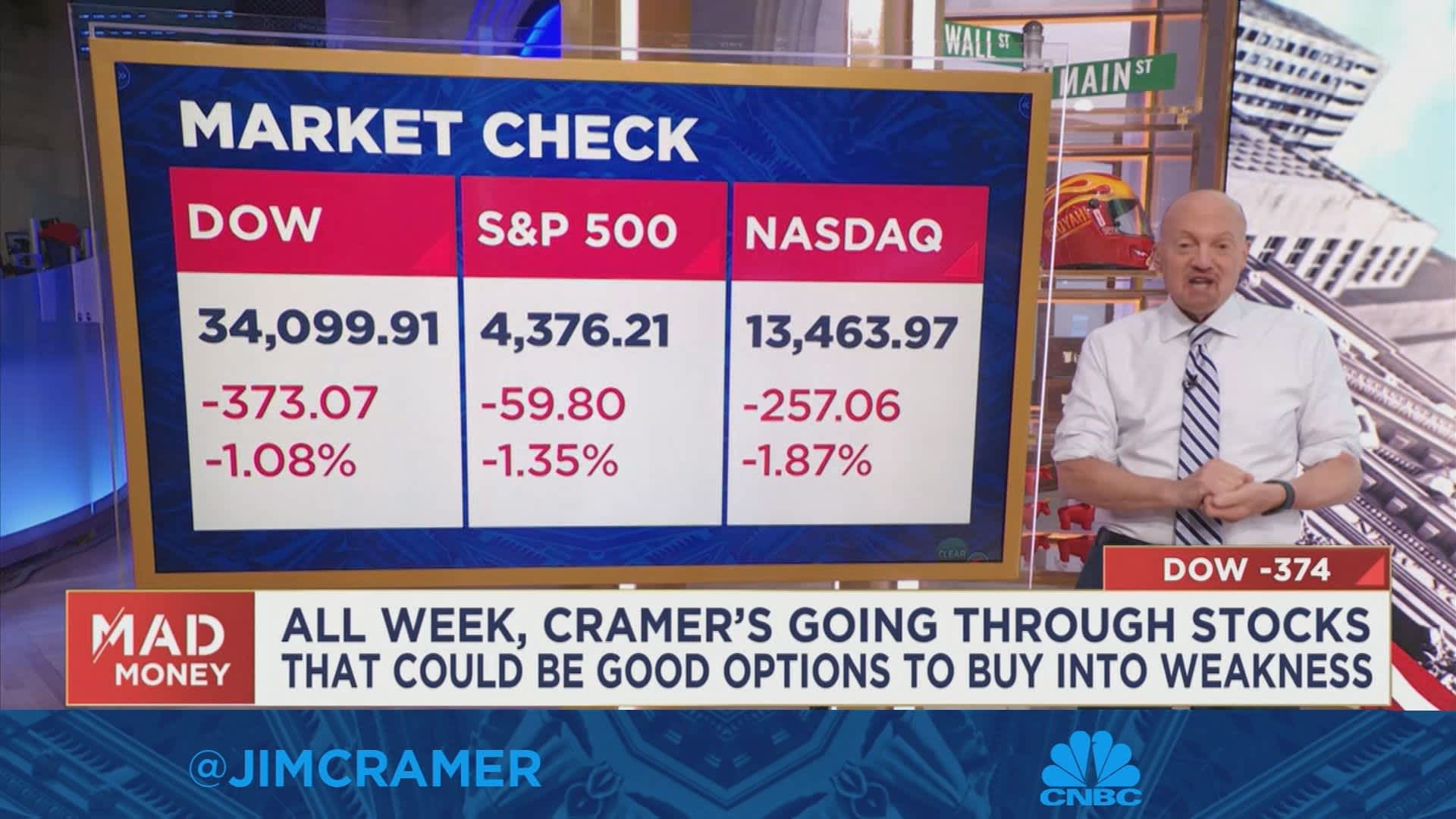

Cramer Urges Early 2026 Profit-Taking: Lock in Gains Without Dumping Everything

Jim Cramer warns that unrealized gains on high-flying stocks are just “paper gains” and urges investors to book profits early in 2026, moving a substantial portion of holdings into cash while still evaluating fundamentals. He cautions against holding moonshots with weak earnings or sales, but says not to sell everything. The idea is to trim positions and avoid chasing risk, using examples like IonQ and Trade Desk to illustrate how fundamentals can deteriorate even after big rallies as the market remains near all-time highs.