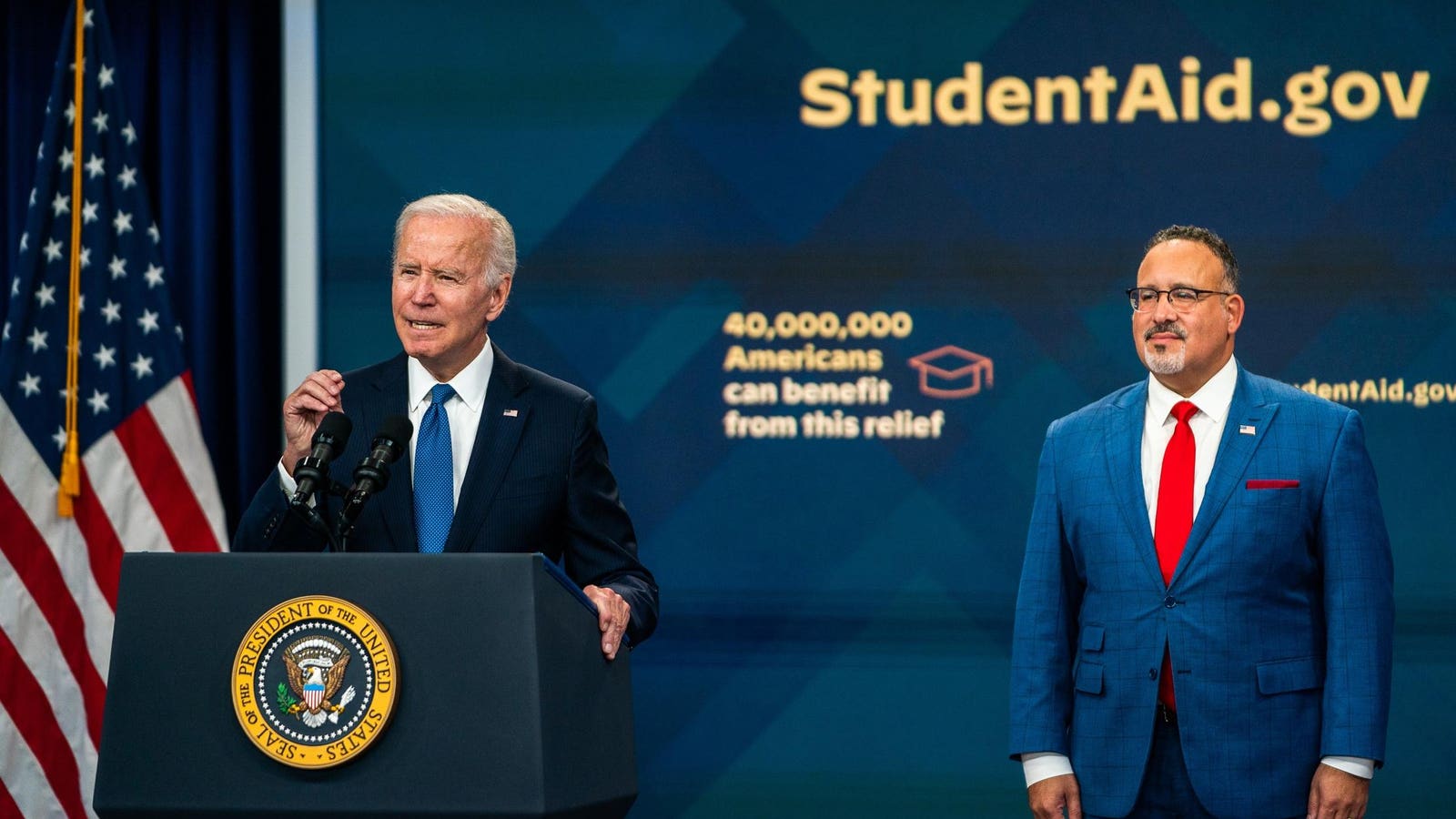

"Key Updates and Programs for Student Loan Forgiveness Revealed by Biden Administration"

The Biden administration has announced updates to the IDR Account Adjustment program, which provides retroactive credit towards student loan forgiveness milestones for borrowers on income-driven repayment plans and Public Service Loan Forgiveness. The program aims to address historical failures in administering student loans and has already approved $44 billion in debt relief for over 900,000 borrowers. One major update is an extension of the deadline to consolidate loans via the federal Direct loan program to qualify for the account adjustment. The Education Department plans to run the adjustment monthly or semi-monthly and expects to complete the adjustment by July 2024. Borrowers will be able to track their progress towards forgiveness through an online tool by the end of 2024.