Robinhood Set for Volatile Q4 Report as HOOD Traders Brace for 11.8% Swing

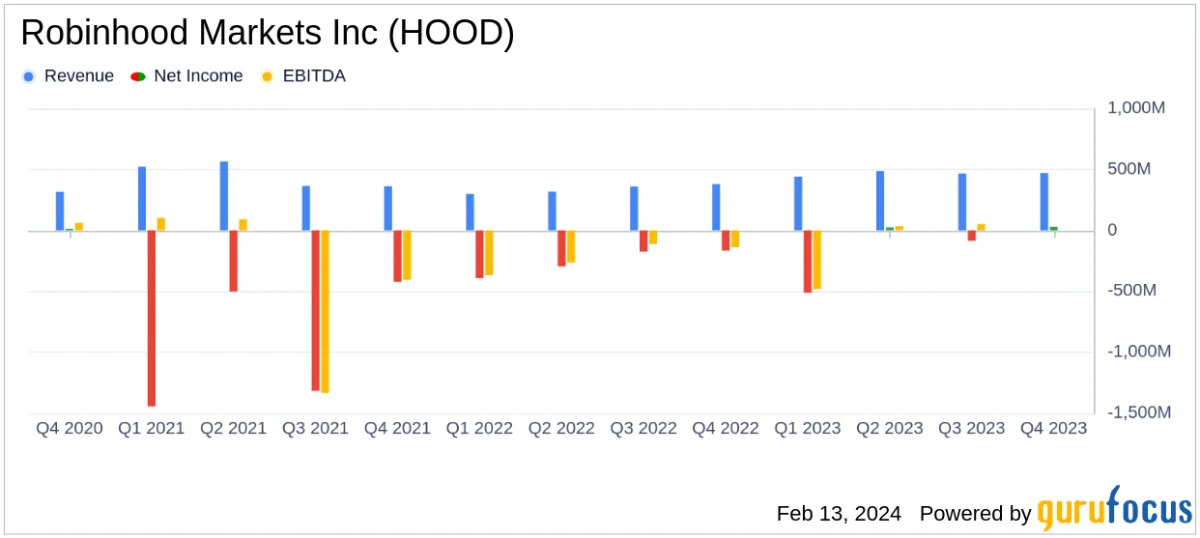

Robinhood Markets is set to report Q4 2025 results on February 10, with the options market pricing an 11.76% move in HOOD stock post-earnings—above the four-quarter average. Analysts expect EPS of $0.63 on revenue of about $1.35B, while investors focus on trading activity, crypto revenue, user growth, and product progress; management guidance could matter if volatility persists. TipRanks rates HOOD Strong Buy with a $150.73 target, implying roughly 82% upside.