"Robinhood's Record Revenues and Surprising Profits Drive Stock Surge"

TL;DR Summary

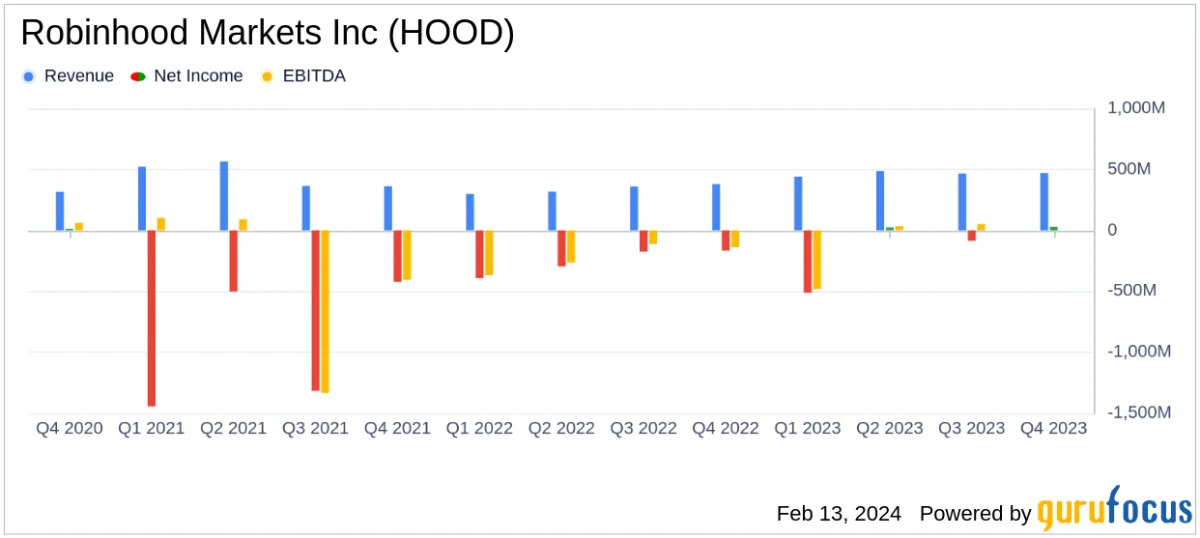

Robinhood Markets Inc reported a record $1.9 billion in revenues for 2023, with Q4 net income at $30 million, a significant improvement from the previous year. The company also saw a 62% increase in Adjusted EBITDA and a 65% surge in Assets Under Custody. Despite a decrease in Monthly Active Users, key metrics such as Funded Customers and Net Deposits reflect the company's ability to attract and retain customers. Robinhood plans to invest in new products, features, and international expansion, projecting operational expenses for 2024 to be in the range of $1.85 billion to $1.95 billion.

Topics:business#earnings-filing#finance#financial-performance#hood#record-revenues#robinhood-markets-inc

- Robinhood Markets Inc (HOOD) Reports Record Revenues in 2023 Earnings Filing Yahoo Finance

- Robinhood stock jumps on surprise Q4 profit Yahoo Finance

- Robinhood's Higher Crypto Revenue Could be Positive for Coinbase Earnings CoinDesk

- Robinhood Stock Jumps On Surprise Profit Fueled By Surge In Crypto, Stock Trading Investor's Business Daily

- Robinhood Shares Rise as Fourth-Quarter Revenue Beats Estimates Bloomberg

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

3 min

vs 4 min read

Condensed

85%

630 → 96 words

Want the full story? Read the original article

Read on Yahoo Finance