BofA's Hartnett Warns Stock Rally Nearing Sell Signal

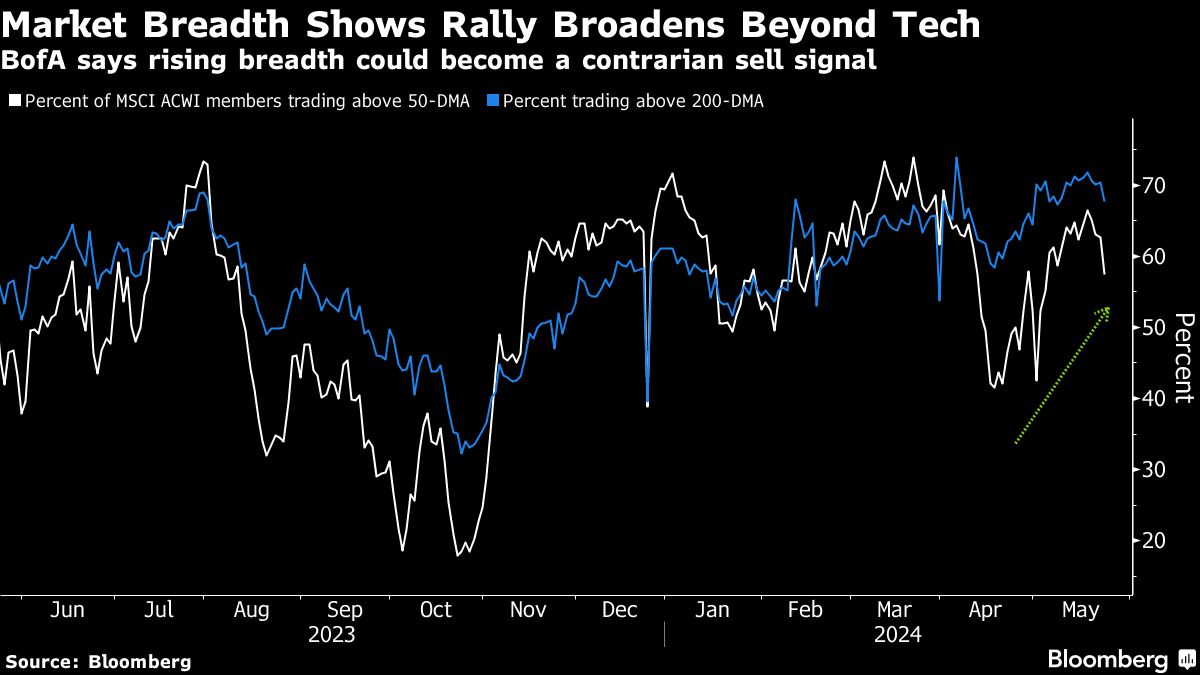

Bank of America strategist Michael Hartnett warns that the global equity market rally is nearing a sell signal, with 71% of equity indexes trading above their 50- and 200-day moving averages. A reading above 88% would trigger a contrarian sell signal. Despite recent gains, the MSCI All-Country World Index saw a decline this week due to strong economic data casting doubt on potential monetary easing. Barclays strategists also noted that the rally appears to be losing momentum.