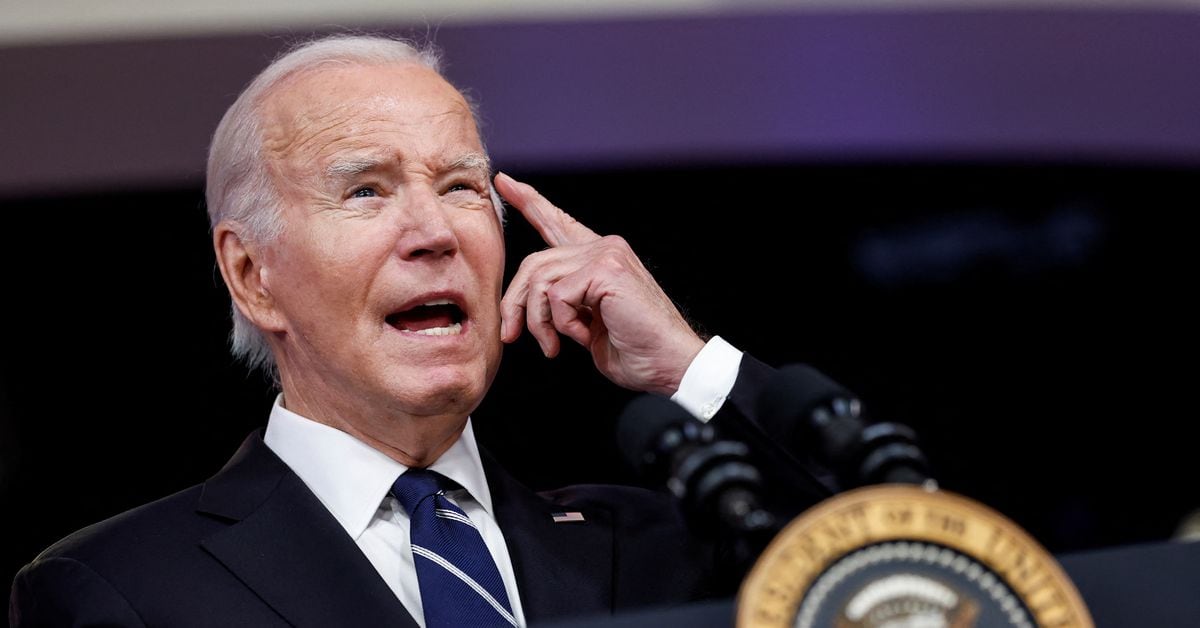

"Biden administration supports sustainable aviation fuel with tax credits, paving the way for biofuels producers"

The Biden administration has announced that it will recognize a methodology favored by the ethanol industry for claiming tax credits on sustainable aviation fuel (SAF), a move that benefits the U.S. corn lobby. However, the administration plans to update the methodology by March 1, which could potentially tighten requirements for SAF feedstocks. The global aviation industry, which accounts for about 2% of global energy-related carbon dioxide emissions, is difficult to decarbonize due to the challenges of electrifying aircraft. SAF can reduce greenhouse gas emissions by 50% over its lifecycle but is more expensive than traditional jet fuel. Ethanol producers see SAF as a way to boost demand amid rising electric vehicle sales. The guidance aims to reduce the price gap between SAF and traditional jet fuel, but the extent of the impact on price discrepancies is unclear. The ethanol industry has lobbied for the recognition of the Department of Energy's GREET model, while environmentalists advocate for feedstocks like used cooking oil and animal fat. The GREET model will be updated to incorporate new data and modeling on emissions sources and strategies to lower emissions.