"China's Two Sessions: Key Points for Traders and Investors"

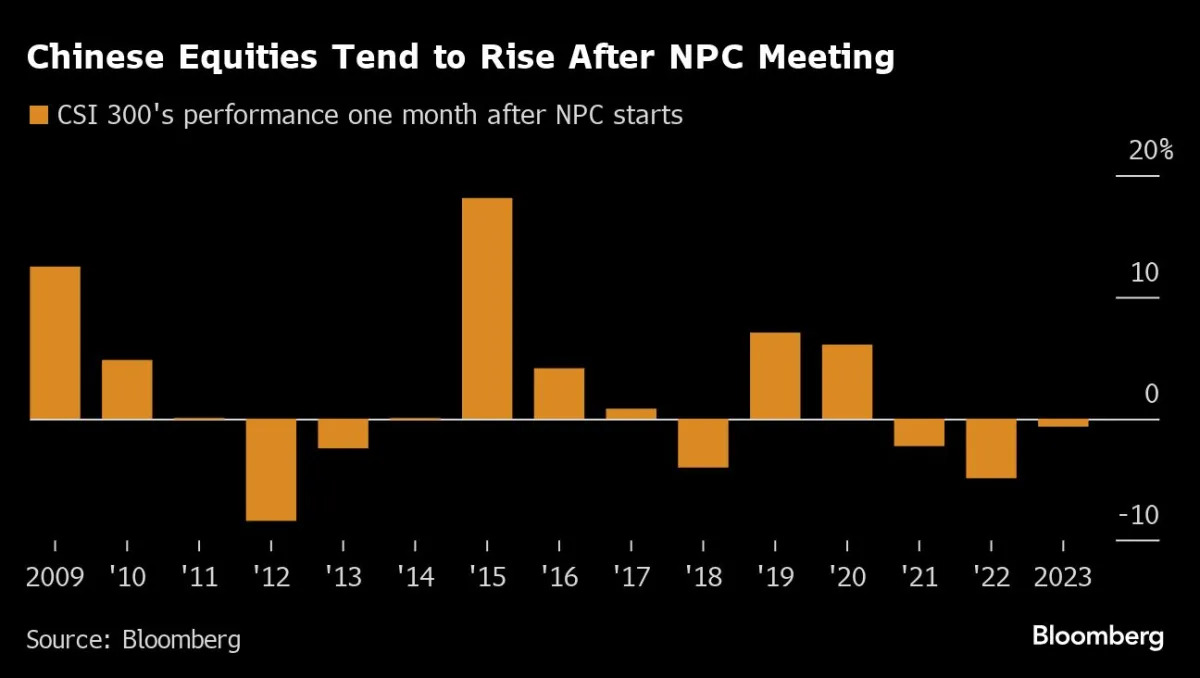

China's equity investors are closely watching the upcoming National People’s Congress meeting for signals on fiscal stimulus, regulatory treatment of companies, and policy priorities. Key focus areas include property relief measures, tech industry policies, state and private firms' valuations, consumer demand, and potential capital market reforms. The meeting comes as China's stock market shows signs of recovery, with the CSI 300 Index heading for a third consecutive week of gains despite recent data showing a contraction in factory activity.