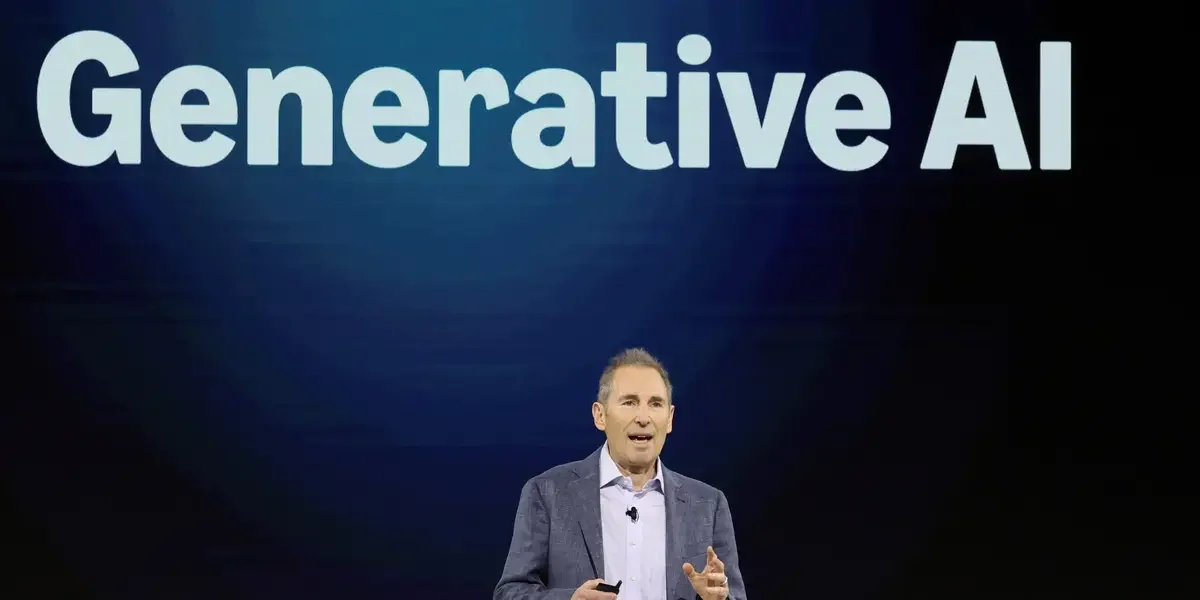

Huang: AI agents will amplify software firms instead of cannibalizing them

Nvidia CEO Jensen Huang argues that markets misread AI’s impact, contending that AI agents will augment rather than cannibalize enterprise software by using existing tools to boost productivity. Nvidia posted a 73% rise in quarterly revenue to $68.13 billion and issued an upbeat Q1 forecast around $78 billion, as investors weigh AI hardware spend against long‑term adoption, with analysts divided on which software players will win or lose.