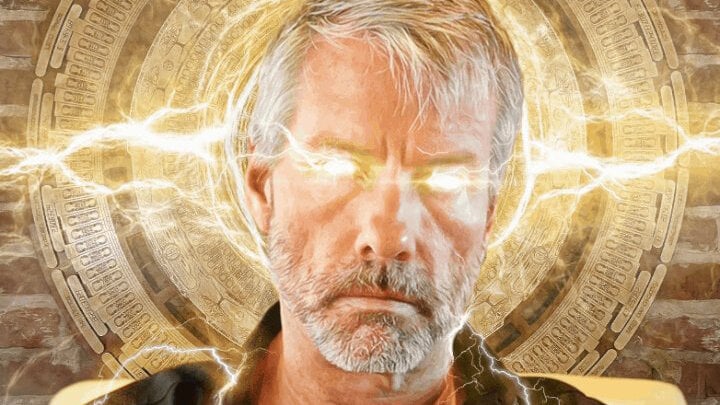

Gilded Colossus: Meme-Coin Backers Push Ahead on Trump Statue Venture

A group of crypto investors funded a 15-foot gilded statue of Donald Trump to promote the $PATRIOT memecoin, installing its pedestal at Trump’s Doral golf complex with plans for an unveiling that may involve the president; the project has been derailed by delays, infighting, and a collapse in the coin’s value, while the sculptor says he’s owed money and IP rights are disputed, and neither the White House nor the Trump Organization have confirmed involvement.