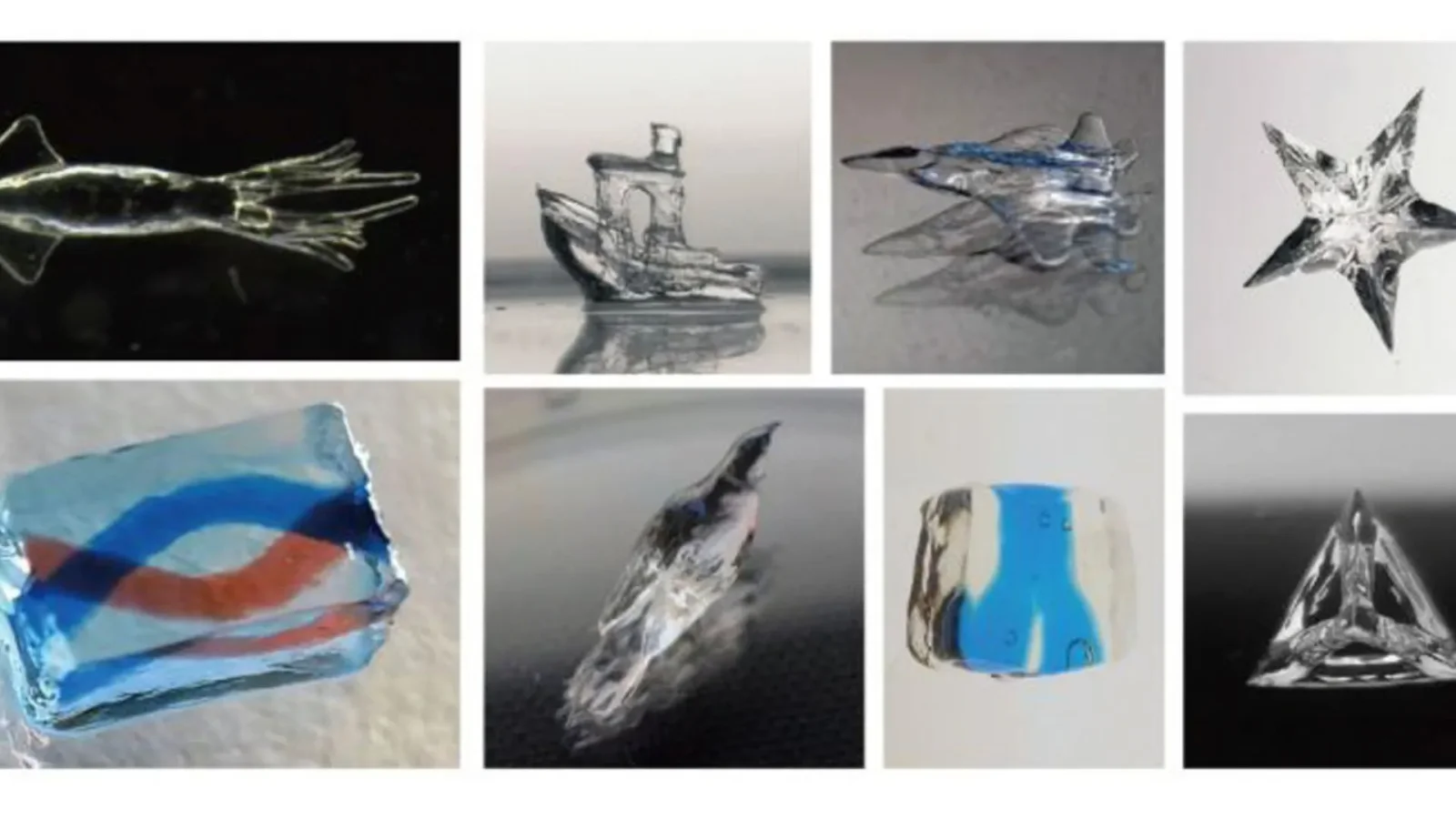

Ultrafast holographic 3D printing creates objects in under a second

Researchers at Tsinghua University demonstrated DISH (Digital Incoherent Synthesis of Holographic light fields), a volumetric 3D printing method that projects a holographic light field into resin to solidify objects in 0.6 seconds with 19 μm resolution, bypassing layer-by-layer construction and enabling rapid, high-detail fabrication with potential applications in biomedicine, robotics, and microelectronics.