PayPal Seeks US Banking License to Expand Small Business Financial Services

PayPal has applied for a banking license in the United States, signaling its intention to expand into traditional banking services and enhance its financial offerings.

All articles tagged with #digital banking

PayPal has applied for a banking license in the United States, signaling its intention to expand into traditional banking services and enhance its financial offerings.

Navy Federal Credit Union experienced a major outage affecting mobile and online banking due to scheduled maintenance, impacting over 15 million members including military families and veterans. The institution has not provided a clear timeline for service restoration, highlighting the importance of digital reliability and effective communication during technical disruptions.

Crypto companies are competing to establish a presence in the US banking sector amid evolving financial regulations, aiming to secure a foothold in the digital banking landscape.

Chime Financial is preparing to go public with an IPO expected to price between $24 and $26 per share, potentially valuing the company at around $9.5 billion. The IPO comes amid strong demand for fintech offerings, following recent successful IPOs like Circle and Voyager Technologies. Chime, popular among young consumers for its low-fee financial products and rapid growth, aims to capitalize on the renewed investor interest in digital banking, with its stock expected to debut on Nasdaq under the ticker CHYM.

Monzo, a British digital bank, reported its first full year of profitability with pre-tax profits of £15.4 million for the 2023-2024 fiscal year, a significant turnaround from a £116.3 million loss the previous year. The bank's revenue more than doubled to £880 million, marking substantial growth and a $5.2 billion valuation.

Ally Financial, a Warren Buffett-backed stock, is recommended as an excellent dividend investment with a 3% yield, reliable payouts, and strong growth potential. As the largest all-digital bank in the U.S. and a top auto lender, Ally combines traditional financial stability with modern digital advantages, making it a solid choice for investors seeking steady and growing dividends.

Thousands of HSBC customers in the UK experienced difficulties accessing mobile and online banking services due to an internal system issue. Complaints began early in the morning and peaked at over 4,000, causing frustration for customers on Black Friday, one of the busiest shopping days. HSBC apologized for the inconvenience and assured customers that they are working to restore the services. This incident highlights the ongoing challenge for banks to prevent such outages as they encourage customers to rely on digital services.

Deutsche Bank plans to close nearly half of its Postbank branches by mid-2026, reducing the number from 550 to around 300, in response to changing customer demand. The bank aims to transform Postbank into a "mobile-first" bank and will offer on-site advice in a new branch format at some locations. The closures are part of the bank's efforts to meet the rising demand for digital banking services and address customer service issues following the integration of its Postbank arm.

American banks are closing branches located within supermarket chains at a rate seven times faster than other locations, as the industry faces profit pressures and customers increasingly shift to digital channels. Regional banks, particularly those hit by the collapse of Silicon Valley Bank, have been under pressure and have closed the most in-store locations. The closure rate for in-store branches was 10.7% in the year ended June 30, compared to 1.4% for other branches. The pandemic accelerated the adoption of mobile and online banking, leading to a sharp increase in branch closures. Banks now view branches as places to attract customers with wealth management accounts, credit cards, and loans, favoring full-sized branches. Despite a slowdown in closures since the peak in 2021, branch closures remain elevated compared to pre-pandemic levels.

SoFi, the digital banking and personal finance company, has reported significant growth since receiving its banking license, with over $2 billion in deposits added each quarter. The company gained over 584,000 new members in Q2, bringing the total to 6.2 million, a 44% increase year over year. SoFi's stock also rallied 20% post-earnings. CEO Anthony Noto attributes the company's success to its mobile-first technology and attractive financial products, such as personal loans and student loan refinancing, which allow customers to lower their monthly payments and manage their finances effectively.

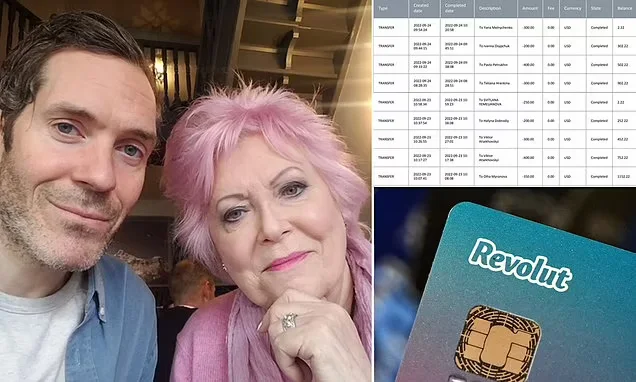

A New York resident has warned Americans of a scam risk after he lost almost $5,000 that he was trying to send to his ailing mother using a payments app called Revolut. The company has been criticized by fraud victims who have not been issued refunds. Revolut allows users to open an account with just a phone number and no paperwork. The neobank launched in the US in 2020, and now boats more than 700,000 US customers.

Acorns, the American micro-investing platform, has acquired GoHenry, a digital banking startup focused on educating kids about money, for an undisclosed sum. The deal will see GoHenry become a wholly owned subsidiary of Acorns, with employees and backers of GoHenry rolling over their equity. Acorns' acquisition of GoHenry signals a major growth bet for the company, which has up until now only been available in the U.S. By buying GoHenry, it will now be able to access Europe, a market that is less advanced when it comes to retail investing.

Small banks are playing a crucial role in providing financial services to underserved communities and promoting financial inclusion. These banks prioritize customer service and community banking, and are increasingly adopting digital banking solutions to better serve their customers. Despite facing challenges such as regulatory burdens and competition from larger banks, small banks continue to thrive and expand their reach.