"Democrats Push for Block on Capital One's $35.3 Billion Discover Acquisition"

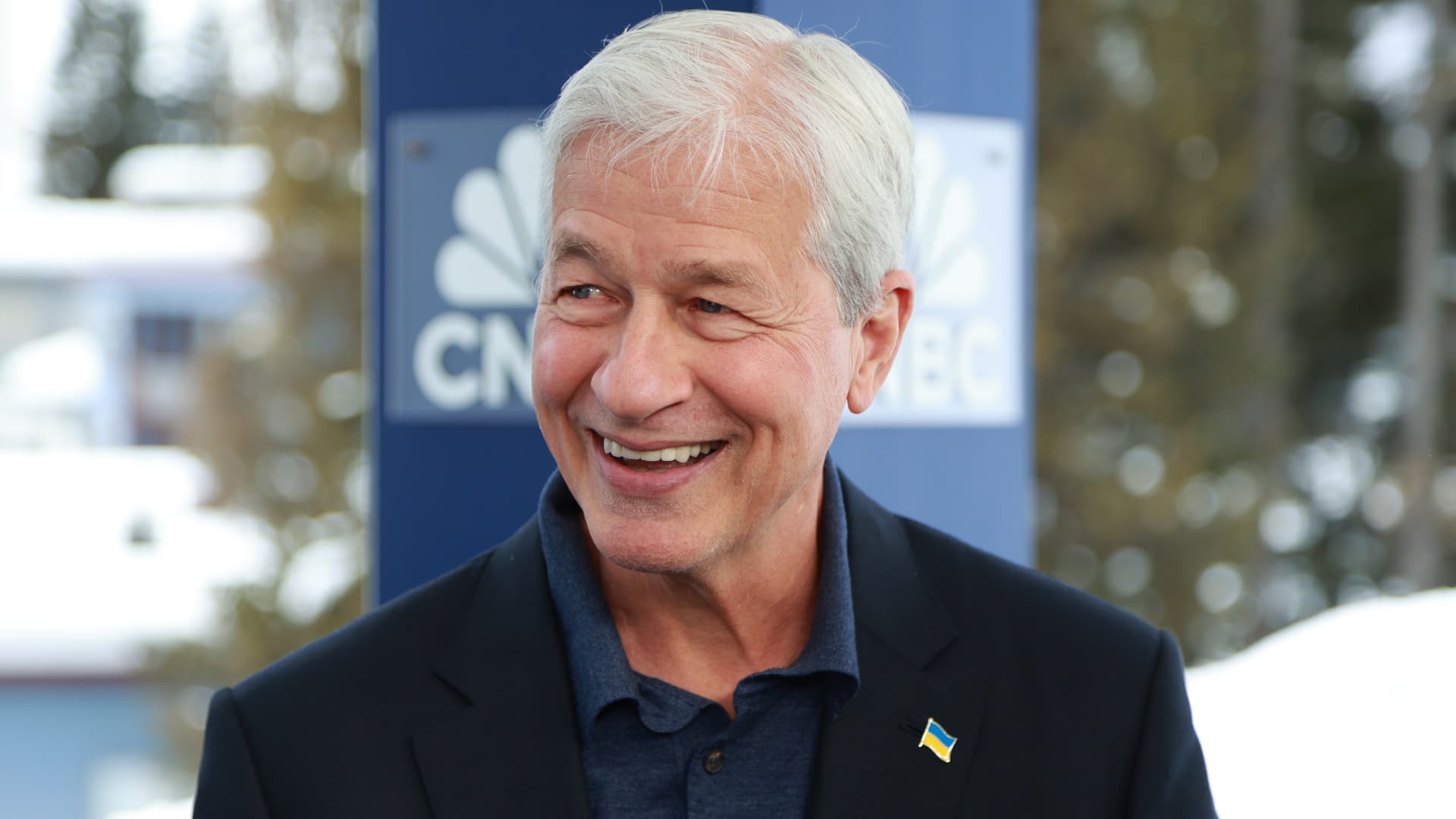

JPMorgan Chase CEO Jamie Dimon expressed confidence in facing competition from Capital One's potential acquisition of Discover Financial, praising Capital One CEO Richard Fairbank while acknowledging the impact on JPMorgan's position as the largest credit-card lender. Dimon highlighted concerns about potential unfair advantages in debit payments and expressed support for small bank mergers. The deal's fate rests on regulatory approval, with some lawmakers urging regulators to block the merger to protect consumers and financial stability.