Fed's Clear Pivot: Morning Bid Begins to Crystallize

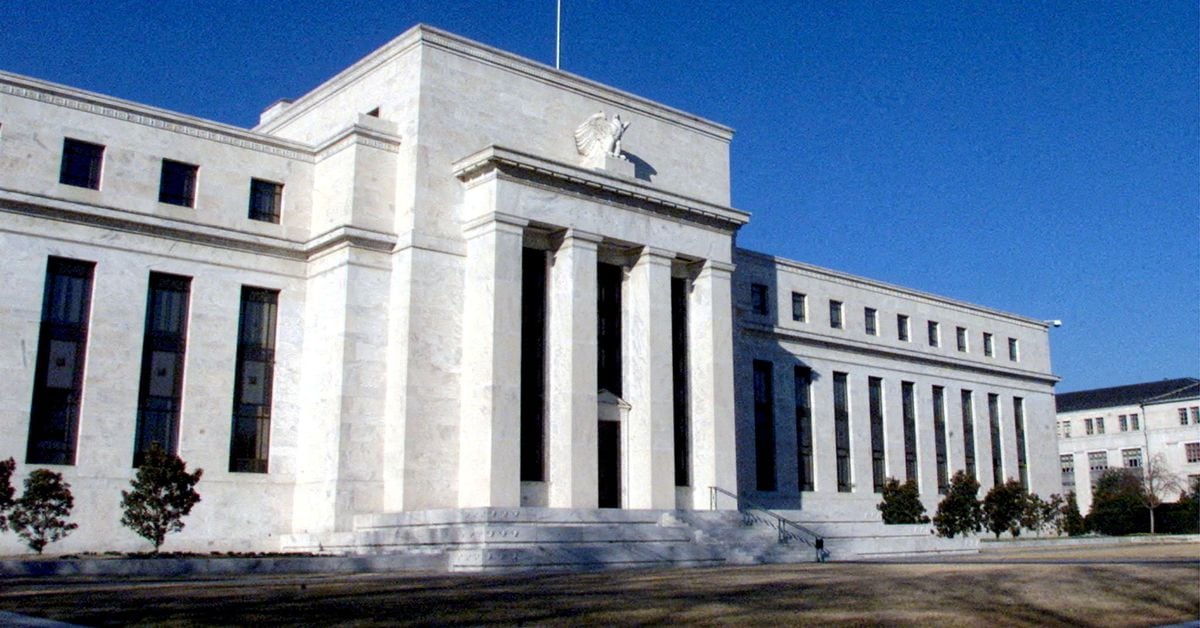

Asian markets are expected to open on a positive note as U.S. bond yields slump following remarks from Federal Reserve officials suggesting that the central bank's interest rate-hiking cycle is over. Atlanta Fed President Raphael Bostic stated that he believes the Fed has finished raising rates, aligning with the dovish stance of other Fed colleagues. This shift in sentiment, along with a decline in oil prices and diminishing flight to safety, is expected to lower the dollar and U.S. yields, boost risk appetite, and lift Asian and emerging markets. However, concerns remain over China's property sector as Country Garden warns about its inability to meet offshore debt obligations, potentially leading to one of the country's biggest debt restructurings. The International Monetary Fund (IMF) has also revised downward China's GDP growth outlook, emphasizing the need for "forceful action" to address issues in the real estate sector. The IMF and World Bank meetings in Morocco, as well as Japan's tankan survey, will provide further direction to the markets.