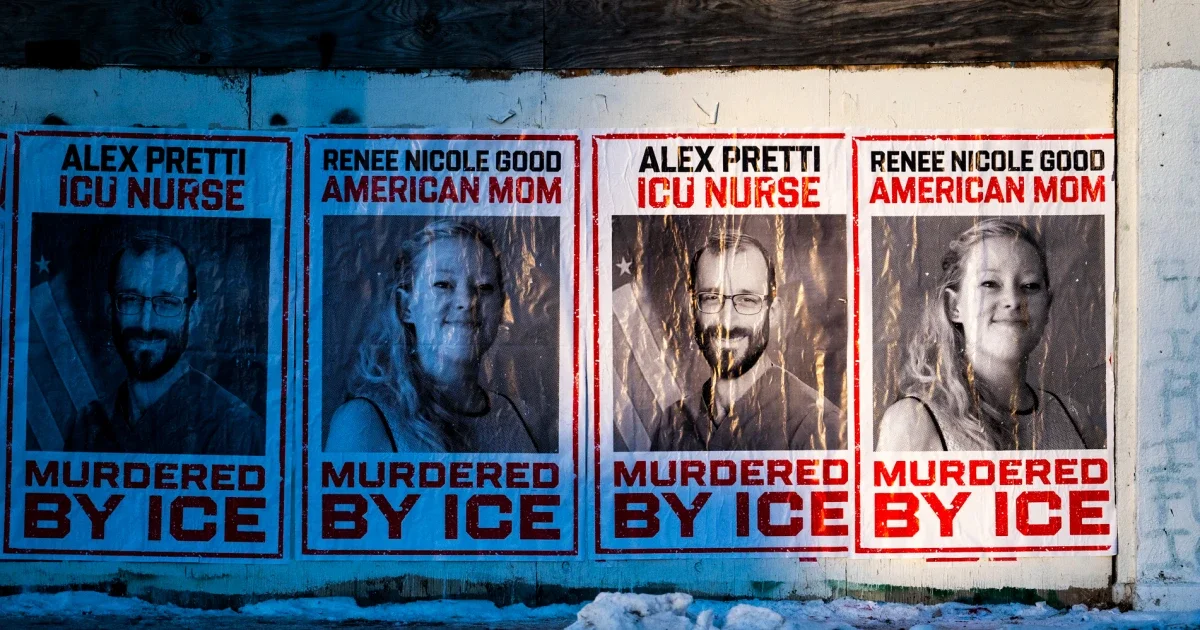

Corporate leaders face tipping point after Minnesota shooting

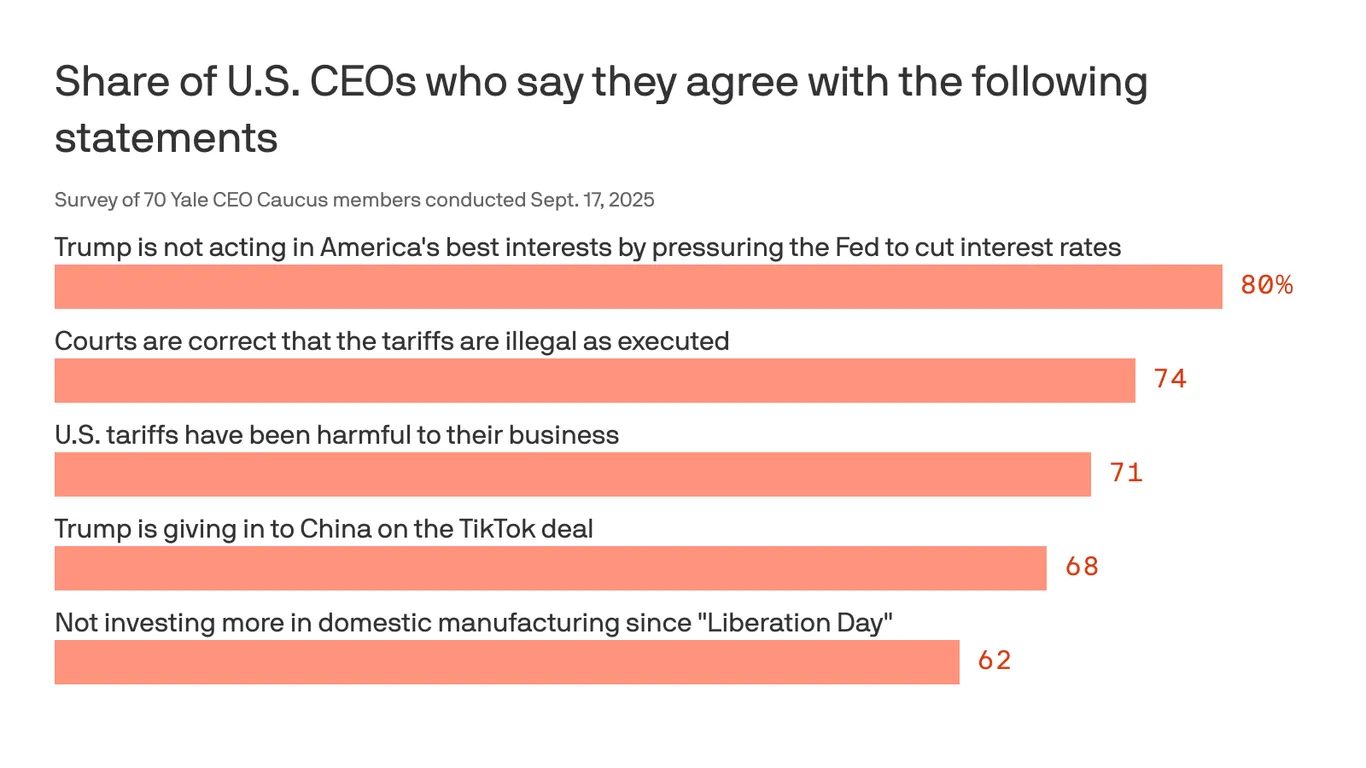

After Alex Pretti’s death at the hands of federal officers in Minneapolis, corporate leaders wrestle with when and how to speak out. A group of Minnesota-based CEOs released a joint letter calling for de-escalation but stopped short of specific actions, while other executives spoke out more quickly and employees circulated an open letter condemning the killings. Experts say CEOs act at ‘tipping points’ and that collective action matters more than loud individual statements, weighing reputational and talent risks against activism and public pressure.