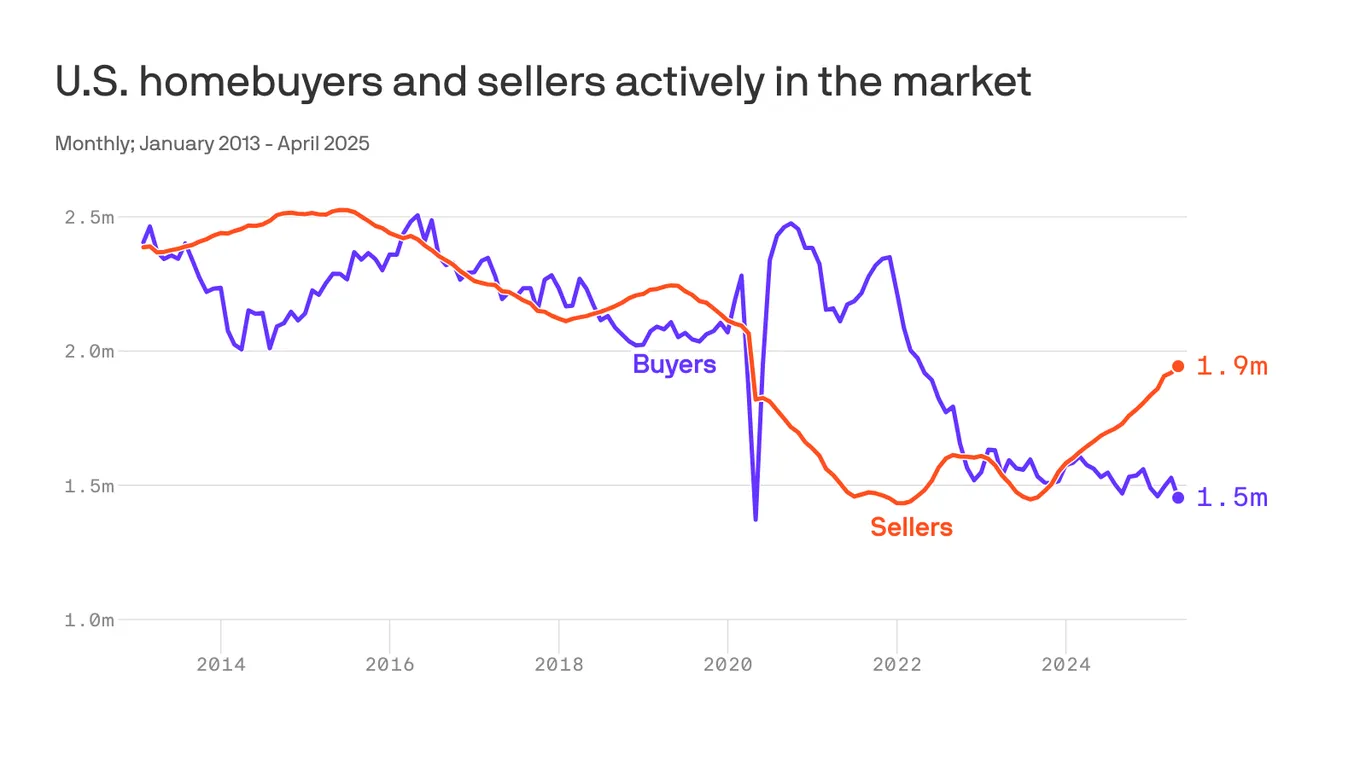

US Housing Market Shifts as Seller Surplus Reaches Record Highs

The US housing market is experiencing a significant shift with 500,000 more homes for sale than buyers, leading to a buyer's market, declining home prices, and increased seller caution, especially for those who bought at peak prices. Experts suggest that now may be a good time for sellers to list their homes before prices dip further, as demand continues to slow and the market cools.