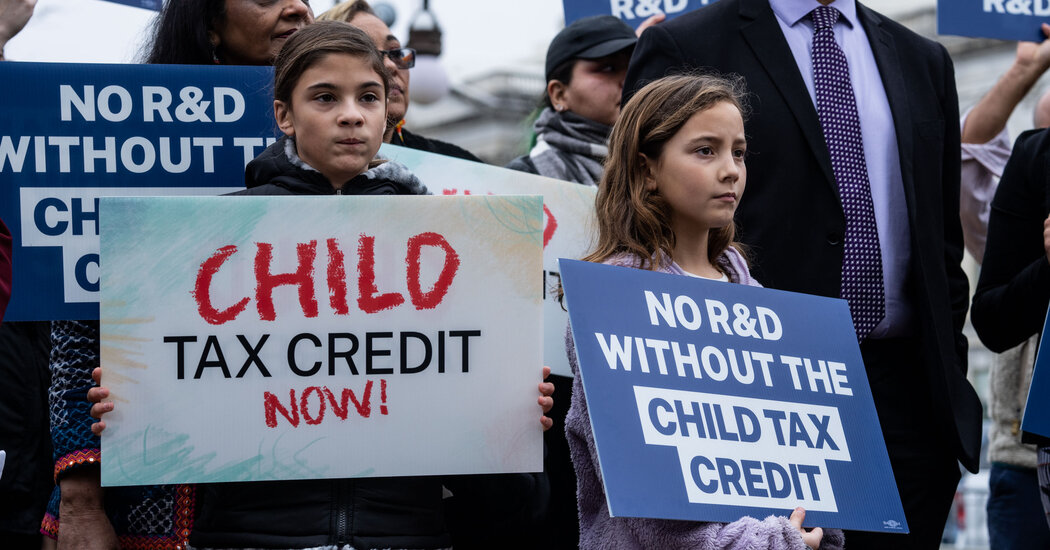

Senate Struggles to Advance Bipartisan Tax Relief Package

A bipartisan tax bill aimed at expanding the child tax credit and reinstating business tax breaks has hit a roadblock in the Senate after receiving broad approval in the House. Senate Republicans have raised concerns about the bill's generosity towards low-income families and its funding mechanism, stalling its progress as the filing deadline approaches. The $78 billion package, negotiated by top congressional tax writers, faces challenges in an election year, with Democrats hoping for a legislative win while Republicans may prefer to avoid it.