"Congress Strikes $78 Billion Tax Deal to Expand Child Tax Credit and Boost Business Breaks"

TL;DR Summary

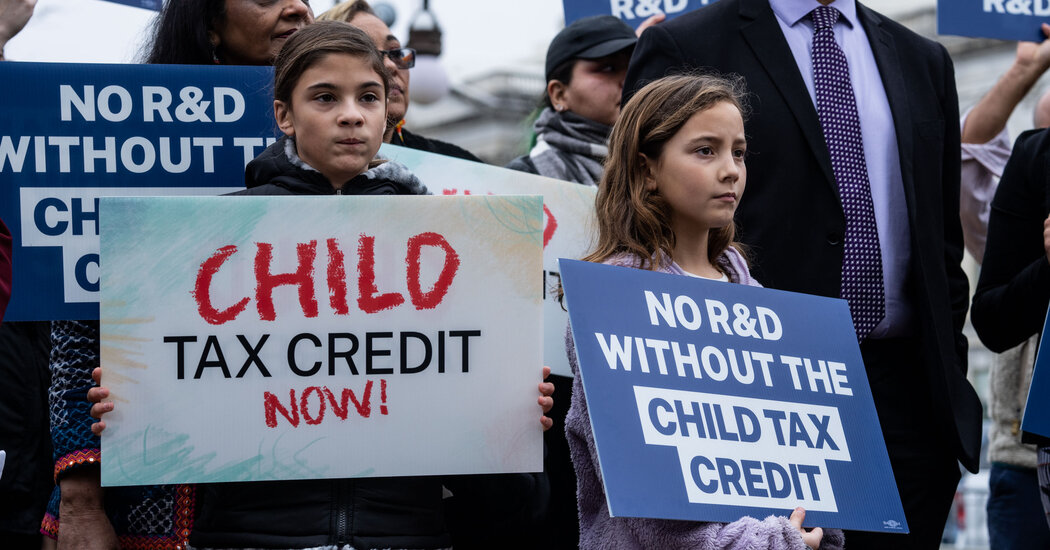

Top Democrats and Republicans in Congress have reached a $78 billion compromise to expand the child tax credit and reinstate three expired business tax breaks, but the package faces challenges in an election year. The plan includes extensions for the child tax credit and business tax benefits through 2025, as well as tax relief for disaster victims and Taiwanese workers and companies operating in the United States. The deal, brokered by Representative Jason Smith and Senator Ron Wyden, aims to be enacted in time for the start of tax filing season this month.

- Lawmakers Strike Tax Deal, but It Faces Long Election-Year Odds in Congress The New York Times

- The child tax credit may expand in 2024. Here's what it means for you. The Washington Post

- Congress announces major tax deal to expand child tax credit and revive breaks for businesses NBC News

- US lawmakers reach $78 bln tax deal for businesses, families Reuters.com

- Tax breaks for parents, businesses possible in last-minute deal POLITICO

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

1 min

vs 2 min read

Condensed

76%

382 → 93 words

Want the full story? Read the original article

Read on The New York Times