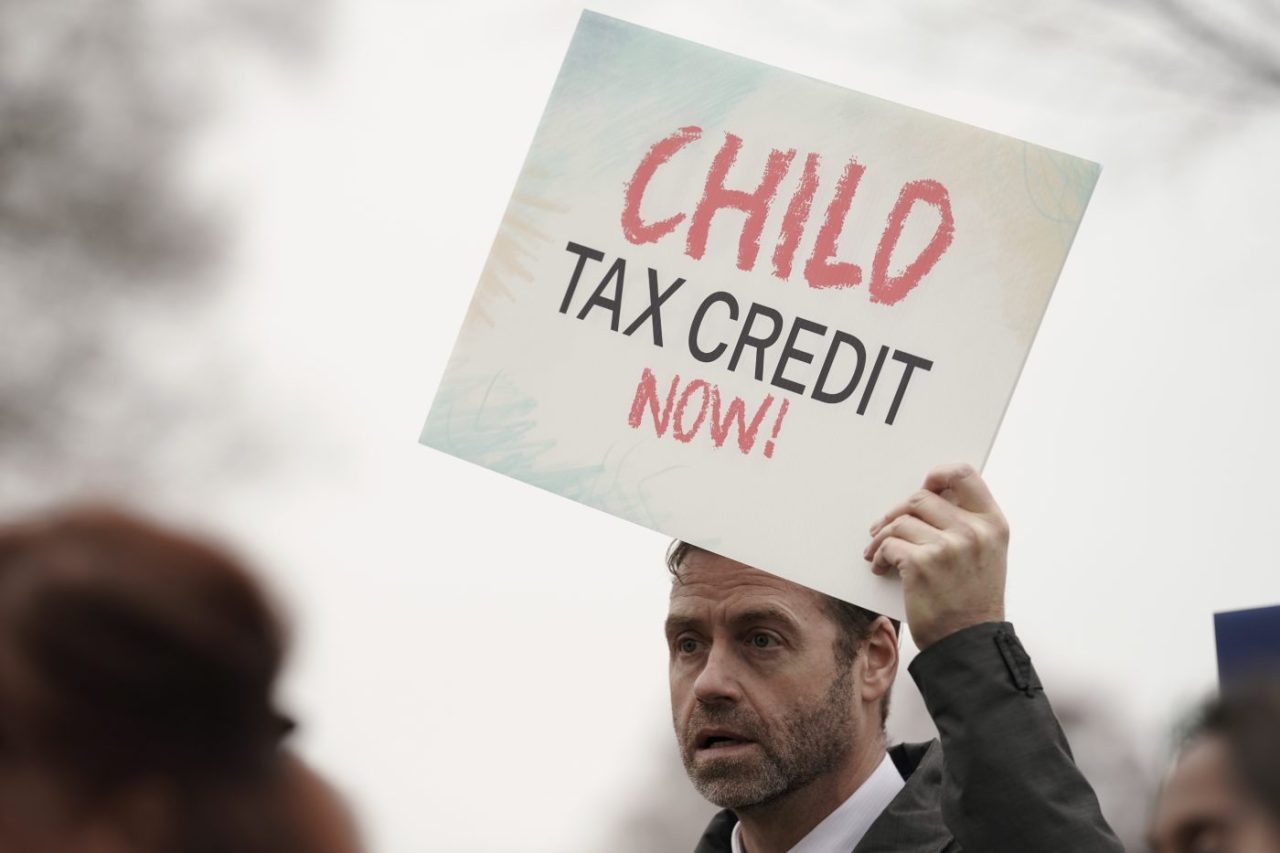

Lawmakers Reach Bipartisan Tax Deal to Expand Child Tax Credit and Boost Business Deductions

House and Senate tax leaders have reached a bipartisan deal to enhance the child tax credit, reinstate business deductions, and increase the low-income housing tax credit. The $80 billion deal aims to nix the employment retention tax credit to fund these changes. The proposal could benefit millions of children and promote innovation and economic competitiveness with China.