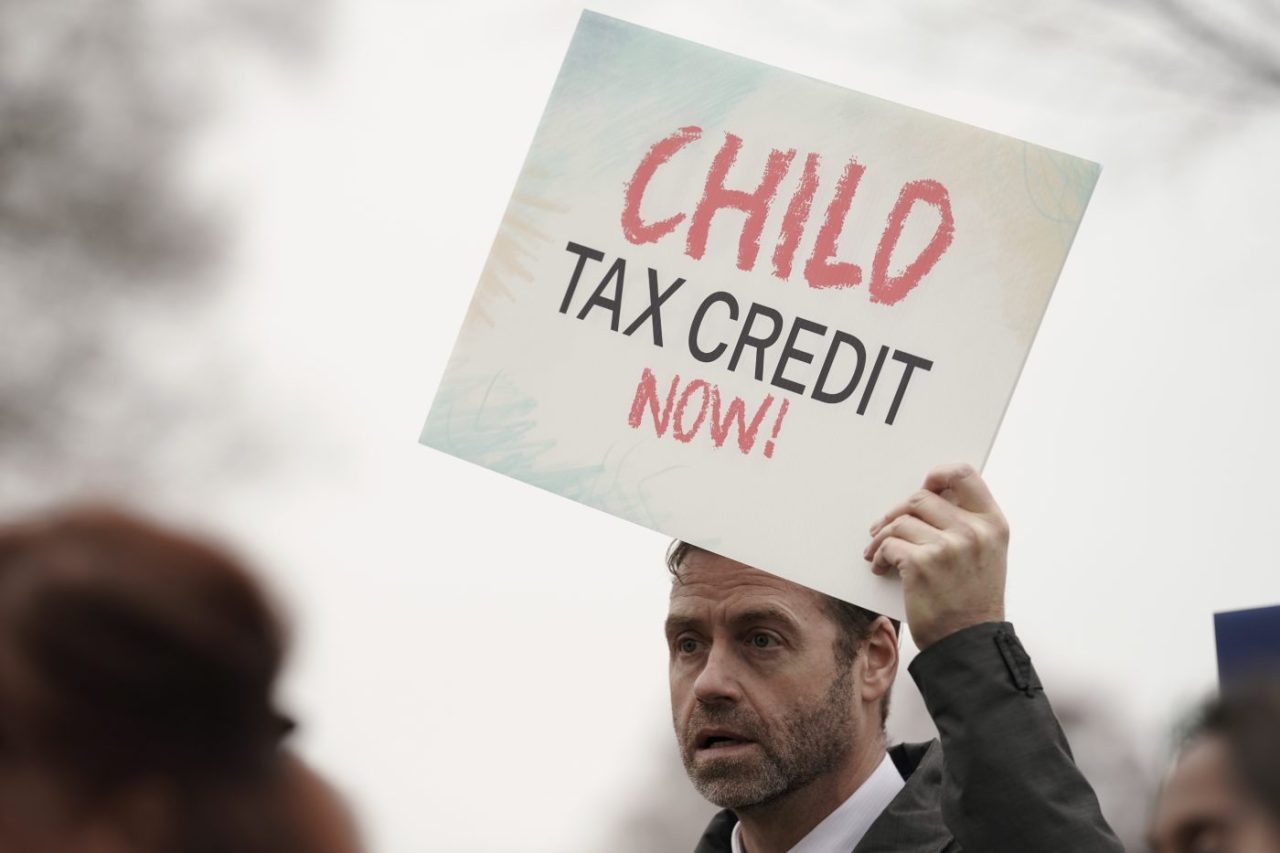

Lawmakers Reach Bipartisan Tax Deal to Expand Child Tax Credit and Boost Business Deductions

TL;DR Summary

House and Senate tax leaders have reached a bipartisan deal to enhance the child tax credit, reinstate business deductions, and increase the low-income housing tax credit. The $80 billion deal aims to nix the employment retention tax credit to fund these changes. The proposal could benefit millions of children and promote innovation and economic competitiveness with China.

- House, Senate tax chiefs announce deal on business deductions, low-income credits The Hill

- US lawmakers reach $78 billion tax deal for businesses, families Yahoo Finance

- Congress announces major tax deal to expand child tax credit and revive breaks for businesses NBC News

- Lawmakers Strike Deal on Expanded Child Tax Credit, but Face Long Odds The New York Times

- Lawmakers ink a bipartisan tax deal to expand the child tax credit Yahoo Finance

Reading Insights

Total Reads

0

Unique Readers

6

Time Saved

2 min

vs 3 min read

Condensed

86%

403 → 57 words

Want the full story? Read the original article

Read on The Hill