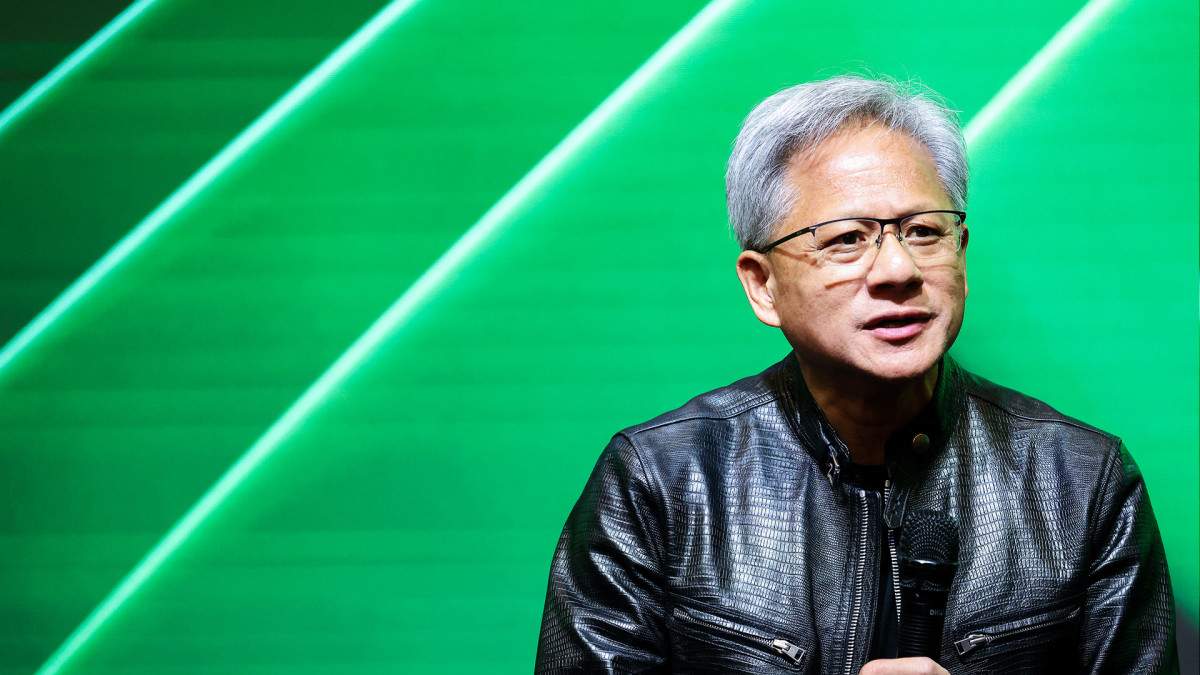

Loop Predicts Nvidia Could Reach $8.5 Trillion Amid AI Boom

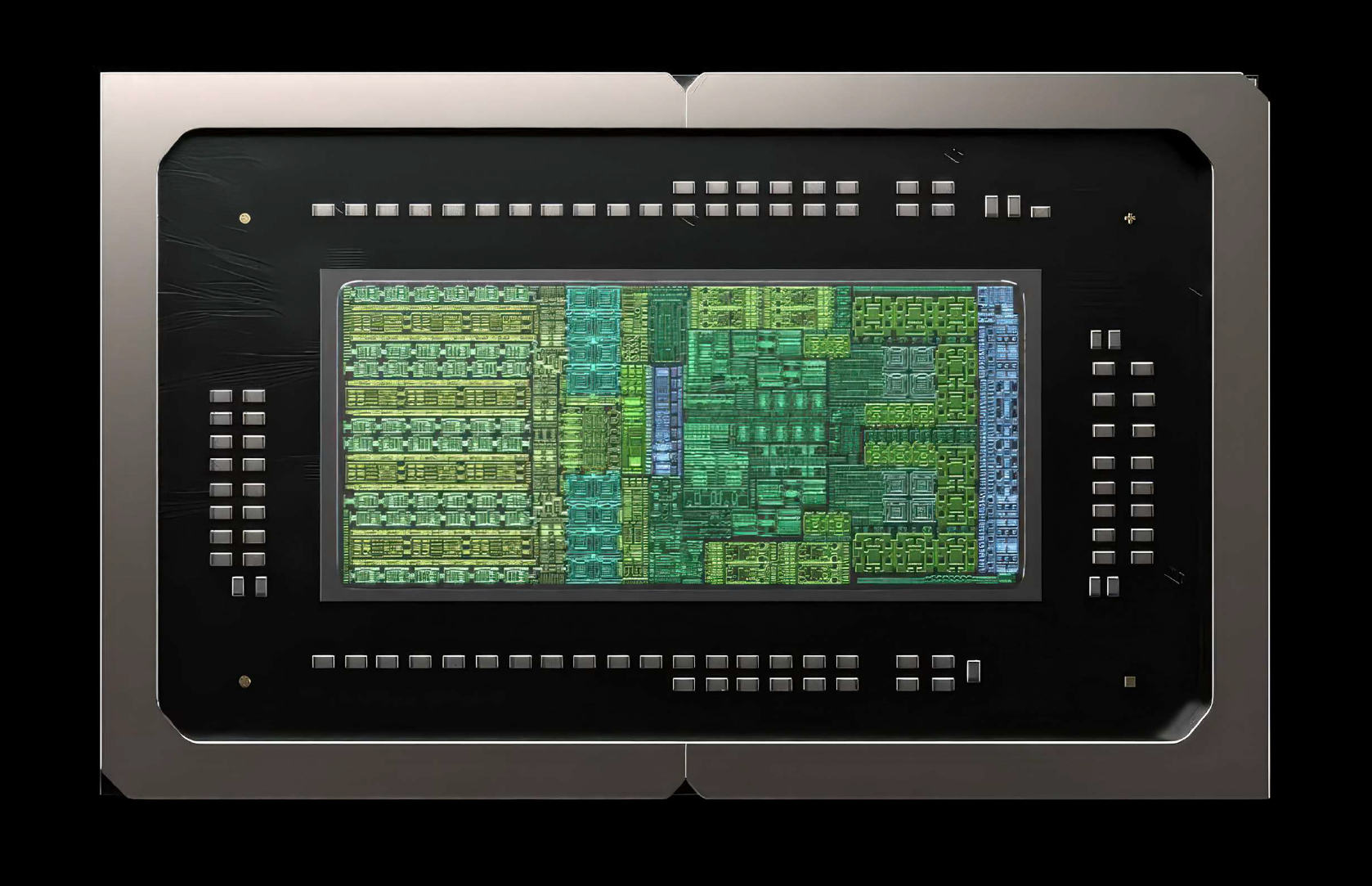

Nvidia is projected to reach over $8.5 trillion in market cap, driven by strong demand for its AI chips and a new 'Golden Wave' of AI adoption, with analysts raising their price targets significantly ahead of its upcoming earnings report.