U.S. Calls for Comprehensive Bank Regulatory Reforms to Enhance Stability and Shareholder Value

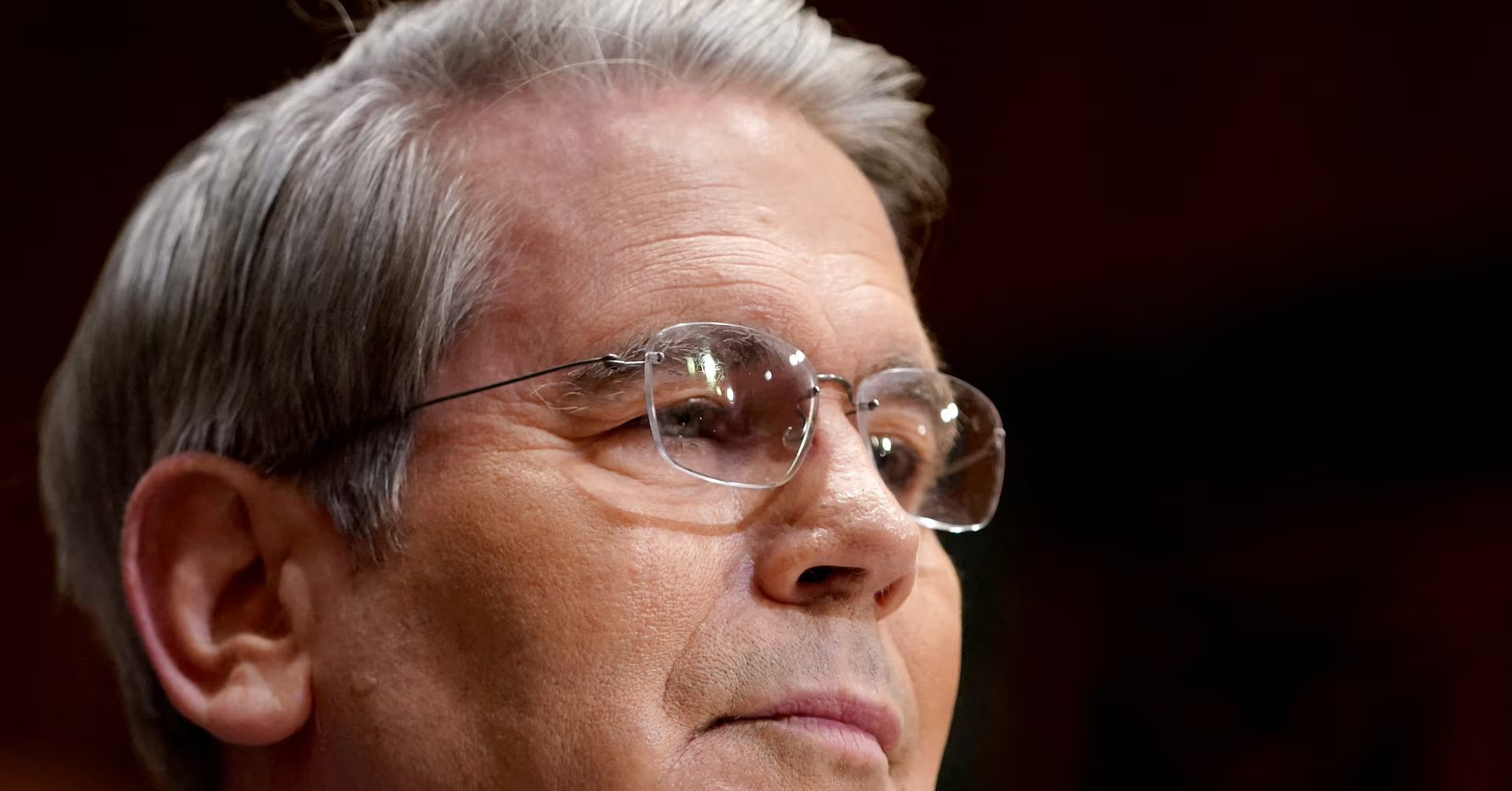

U.S. Treasury Secretary Scott Bessent advocates for comprehensive reforms in the financial regulatory system, criticizing the Biden-era dual capital requirement proposal and calling for reduced capital burdens on banks to promote lending and economic growth, while emphasizing the need for a long-term, innovation-driven blueprint for financial stability.