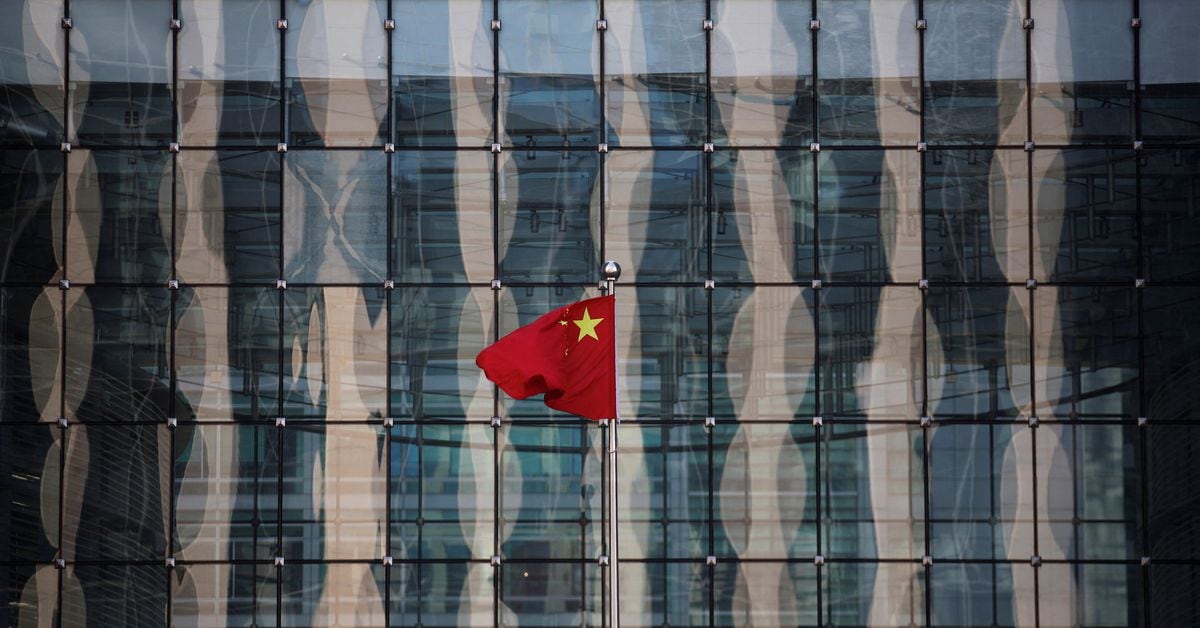

Moody's warns of China's credit downgrade amid mounting growth and property pressures

TL;DR Summary

Moody's has issued a downgrade warning on China's credit rating, citing the costs of bailing out local governments and state firms, as well as the challenges in controlling the property crisis. The ratings agency lowered the outlook on China's A1 debt rating to "negative" from "stable," expressing concerns about the country's fiscal sustainability and medium-term economic growth. China's Finance Ministry called the decision disappointing and stated that the economy would rebound. The property crisis and local government debt worries are seen as controllable.

- Moody's puts China on downgrade warning as growth, property pressures mount Reuters

- China's credit rating downgraded, here's what it means for Tesla, Apple, Nike, LVMH Yahoo Finance

- Stock Index Futures Slip Ahead of U.S. JOLTs Report, China Credit Outlook Downgrade Weighs Barchart

- China's Rising Debt Spurs Moody's to Lower Credit Outlook The New York Times

- Moody’s Lowers China Credit Outlook on Rising Debt Bloomberg Television

Reading Insights

Total Reads

0

Unique Readers

6

Time Saved

4 min

vs 5 min read

Condensed

90%

868 → 83 words

Want the full story? Read the original article

Read on Reuters