"Assessing the Impact of CPI Reports on Fed Rate Cut Odds and Mortgage Interest Rates"

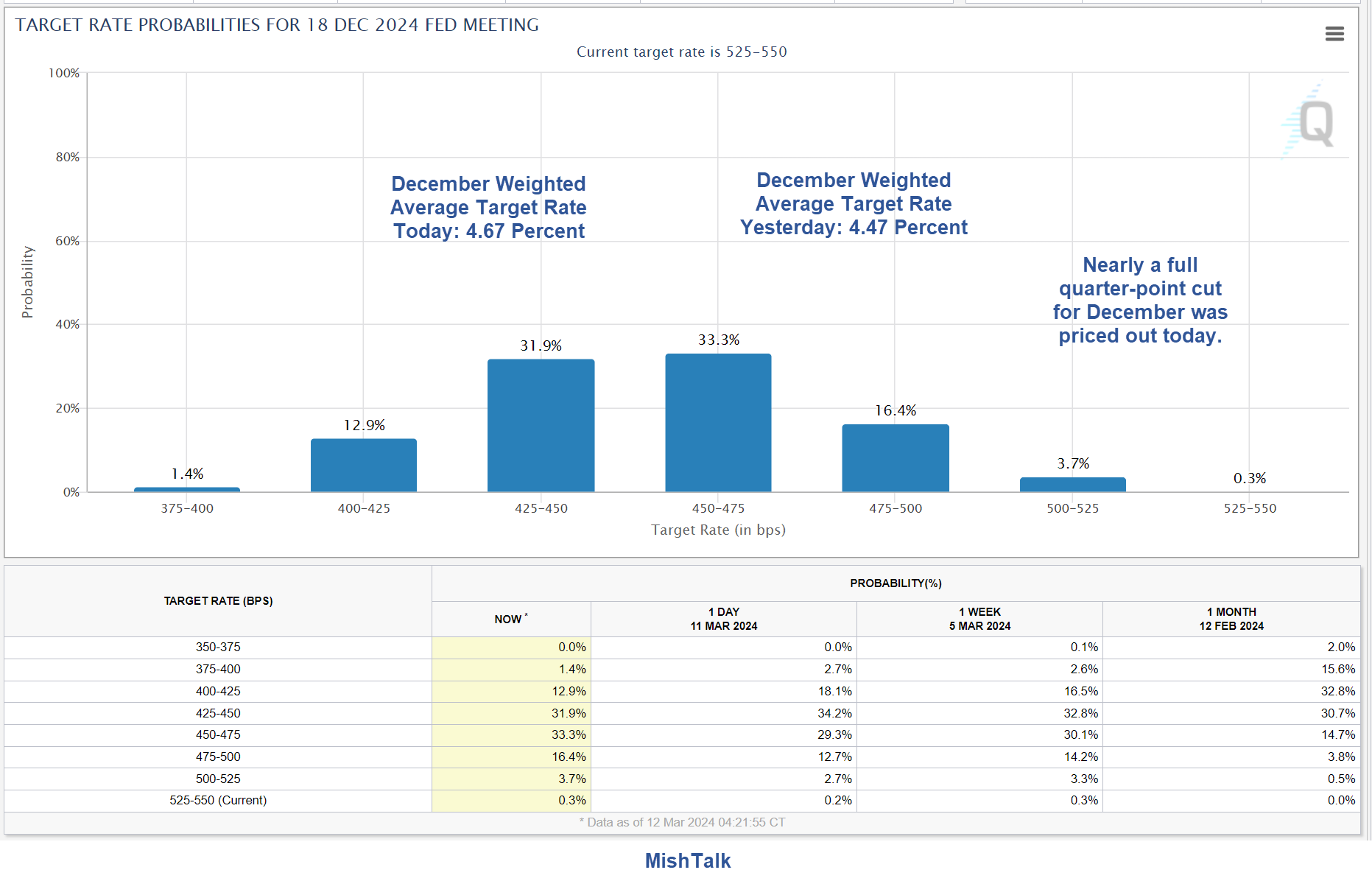

Despite a second hotter than expected CPI report, CME Fedwatch rate cut odds for June barely changed, but odds did shift for November and December. The Fed signaled a rate cut for June, and the market has priced this in, with expectations for no cut in March and increased odds for no cut in May. The market remained unfazed by the hot CPI data until November, when expectations for higher rates rose. Fed officials have indicated a willingness to lower rates despite inflation readings, and the Fed's decision to cut in June seems set, barring significant CPI data changes. The article also discusses the potential impact of asset bubbles, recession odds, and ongoing inflationary factors.

- How Did a Second Hot CPI Report Impact Fed Rate Cut Odds? Mish Talk

- It's a Higher-for-Longer World for Rates, and That's OK The Wall Street Journal

- Leave things alone: Fed shouldn’t cut rates until recession is an actual threat MarketWatch

- Federal Reserve could hold off on rate cuts as economy outperforms Yahoo Finance

- Will mortgage interest rates drop after the Fed's March meeting? Here's what experts predict CBS News

Reading Insights

0

1

3 min

vs 4 min read

83%

694 → 115 words

Want the full story? Read the original article

Read on Mish Talk