The Rise and Fall of Silicon Valley Bank: Lessons Learned.

TL;DR Summary

Silicon Valley Bank, which provided financing for almost half of US venture-backed technology and health care companies, experienced a bank run that led to its collapse. The bank's fall was the largest failure of a US bank since Washington Mutual in 2008. The story begins years ago with moves made by the Federal Reserve and investment decisions by the bank.

Topics:business#bank-run#federal-reserve#finance#investment-decisions#silicon-valley-bank#us-venture-backed-companies

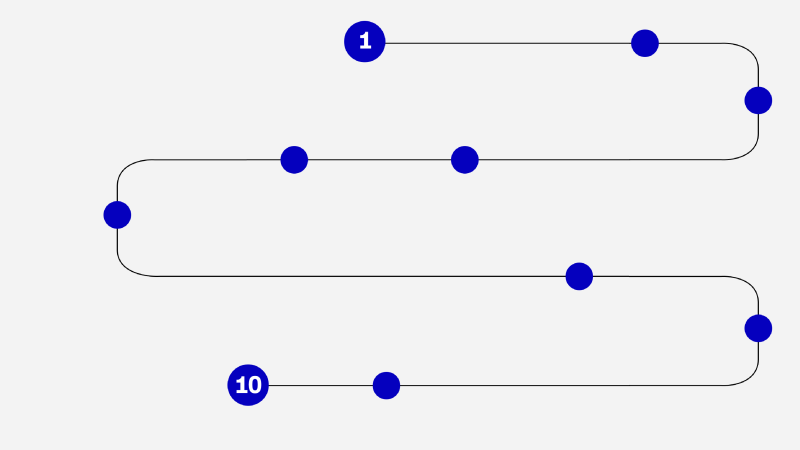

- What's a bank run? The 10 moves that led to Silicon Valley Bank's astonishing fall CNN

- TUCKER CARLSON: We're getting moral lectures from the banks Fox News

- The Silicon Valley Bank collapse wasn’t unique, it was just first The Boston Globe

- Opinion | How Bad Was the Silicon Valley Bank Bailout? The New York Times

- Opinion | In the Silicon Valley Bank debacle, greed and fear ruled, not the rules The Washington Post

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

0 min

vs 1 min read

Condensed

47%

113 → 60 words

Want the full story? Read the original article

Read on CNN