Stock Market Remains Resilient Amid Middle East Violence and Biden Security Plan Challenges

TL;DR Summary

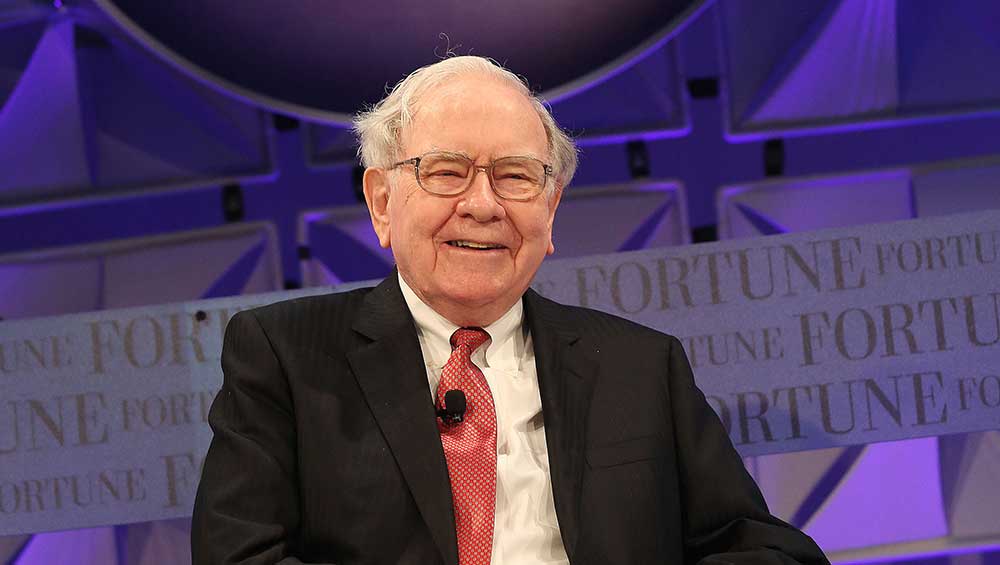

The Dow Jones Industrial Average rallied as investors shrugged off geopolitical concerns and defense stocks like General Dynamics, L3Harris Technologies, and Northrop Grumman made significant gains. Chevron and Occidental Petroleum, both Warren Buffett stocks, tested new entry points. Meanwhile, Cadence Design Systems tested a buy point. Treasury Secretary Janet Yellen's oil price pledge in response to the Middle East hostilities did not dampen the rise of energy stocks, with SLB, Exxon Mobil, ConocoPhillips, Baker Hughes, and BP all gaining. Walt Disney was the top performer on the Dow, while Coca-Cola and Procter & Gamble lagged.

- Dow Jones Rallies As Yellen Makes Oil Price Pledge; These Warren Buffett Stocks Test Entries Investor's Business Daily

- Here's why the stock market is taking Middle East violence in stride CNBC

- Wall Street Turns Green Despite Violence and Tragedy in Middle East RealMoney

- Stock Market Bulls Put Faith In Market Mechanics — Bloodshed Ruins Biden Security Plan — The Choke Point Benzinga

- View Full Coverage on Google News

Reading Insights

Total Reads

0

Unique Readers

7

Time Saved

5 min

vs 6 min read

Condensed

92%

1,194 → 95 words

Want the full story? Read the original article

Read on Investor's Business Daily