Berkshire Hathaway Takes Stake in The New York Times

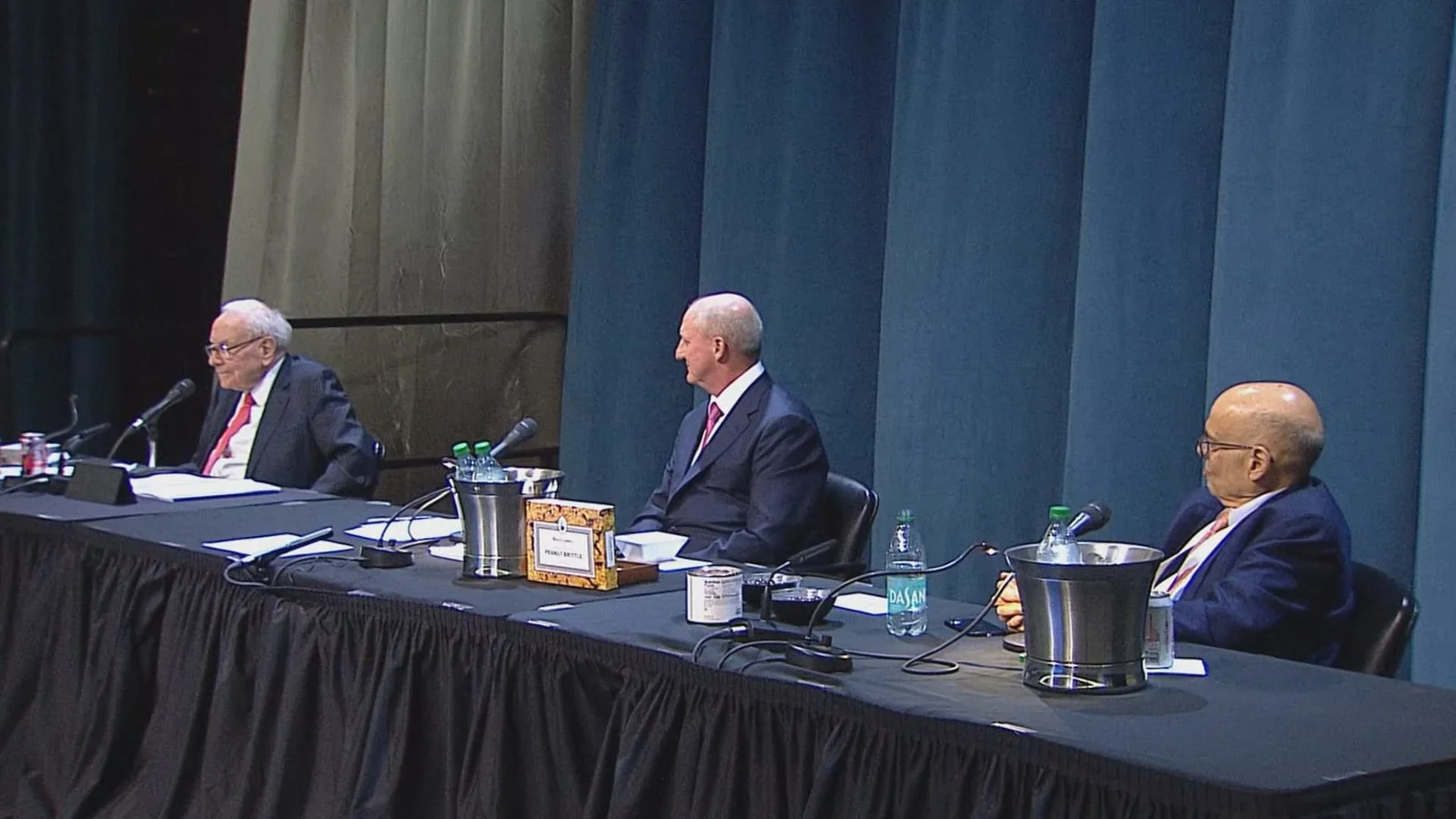

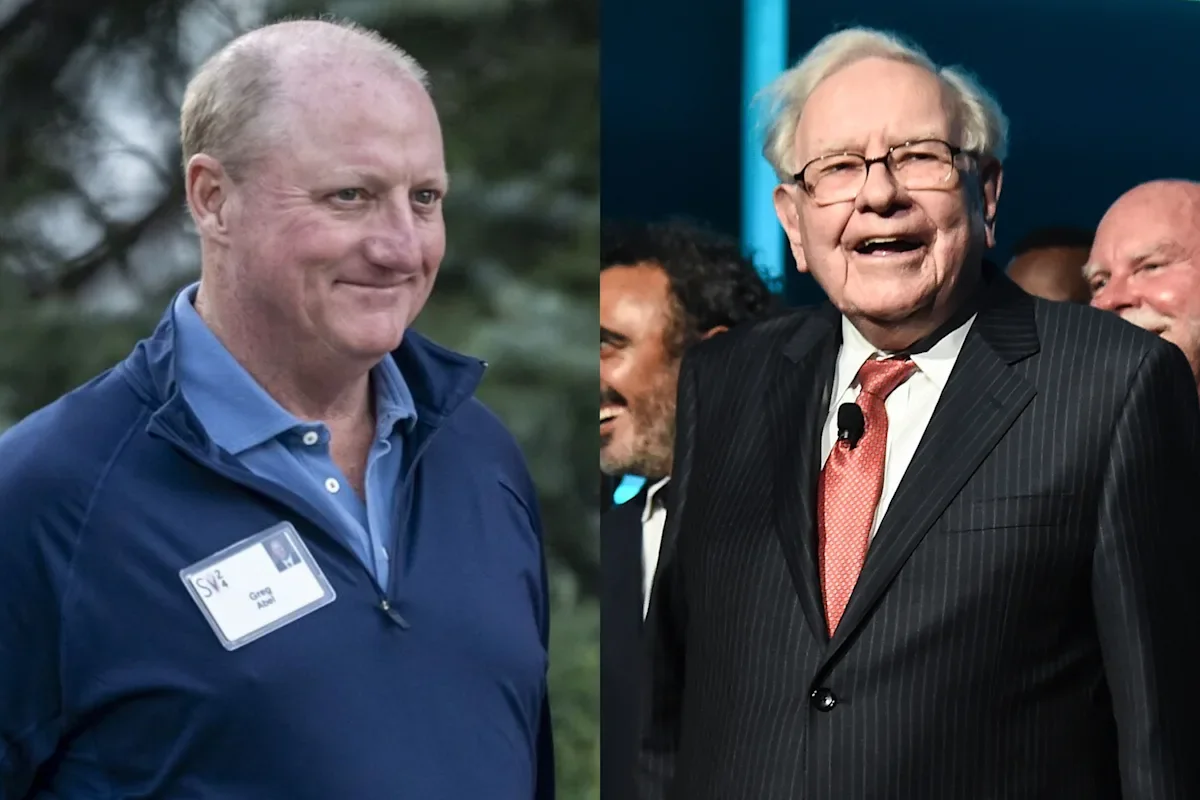

Berkshire Hathaway disclosed an investment in The New York Times, underscoring Warren Buffett's ongoing interest in media assets and signaling a long-term vote of confidence in the Times' business prospects.