Shake Shack Stock Rockets on Strong Earnings and Demand Upsurge

TL;DR Summary

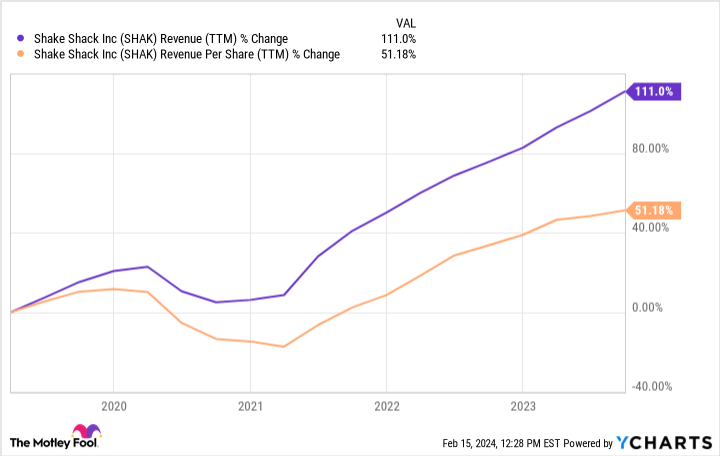

Shake Shack's stock soared 23% after reporting strong Q4 2023 financial results, with a 1.4% increase in year-over-year restaurant traffic and a 20% restaurant-level operating margin. Despite positive results, an increasing share count dilutes shareholder profits, leading to concerns about the stock's valuation. The company expects 11-15% top-line growth in fiscal 2024, driven by new restaurant openings. However, some analysts caution that the stock may be overvalued, suggesting investors consider taking profits as shares hit 52-week highs.

Topics:business#finance#financial-results#restaurant-industry#shake-shack#shareholder-profit#stock-market

- Why Shake Shack Stock Skyrocketed Today Yahoo Finance

- Shake Shack stock surges 26% on fourth-quarter profit, strong 2024 outlook CNBC

- Shake Shack surges as strong burger demand fuels quarterly beat Yahoo Finance

- Shake Shack Stock Is Soaring. Sweet Earnings Aren’t the Only Reason. Barron's

- Shack Is Back: Shake Shack's Stock Rallies To 2-Year High Forbes

Reading Insights

Total Reads

0

Unique Readers

6

Time Saved

2 min

vs 3 min read

Condensed

84%

479 → 77 words

Want the full story? Read the original article

Read on Yahoo Finance