"SEC Votes to Tighten Rules for Blank-Check SPAC Companies Amid Fizzling Mania"

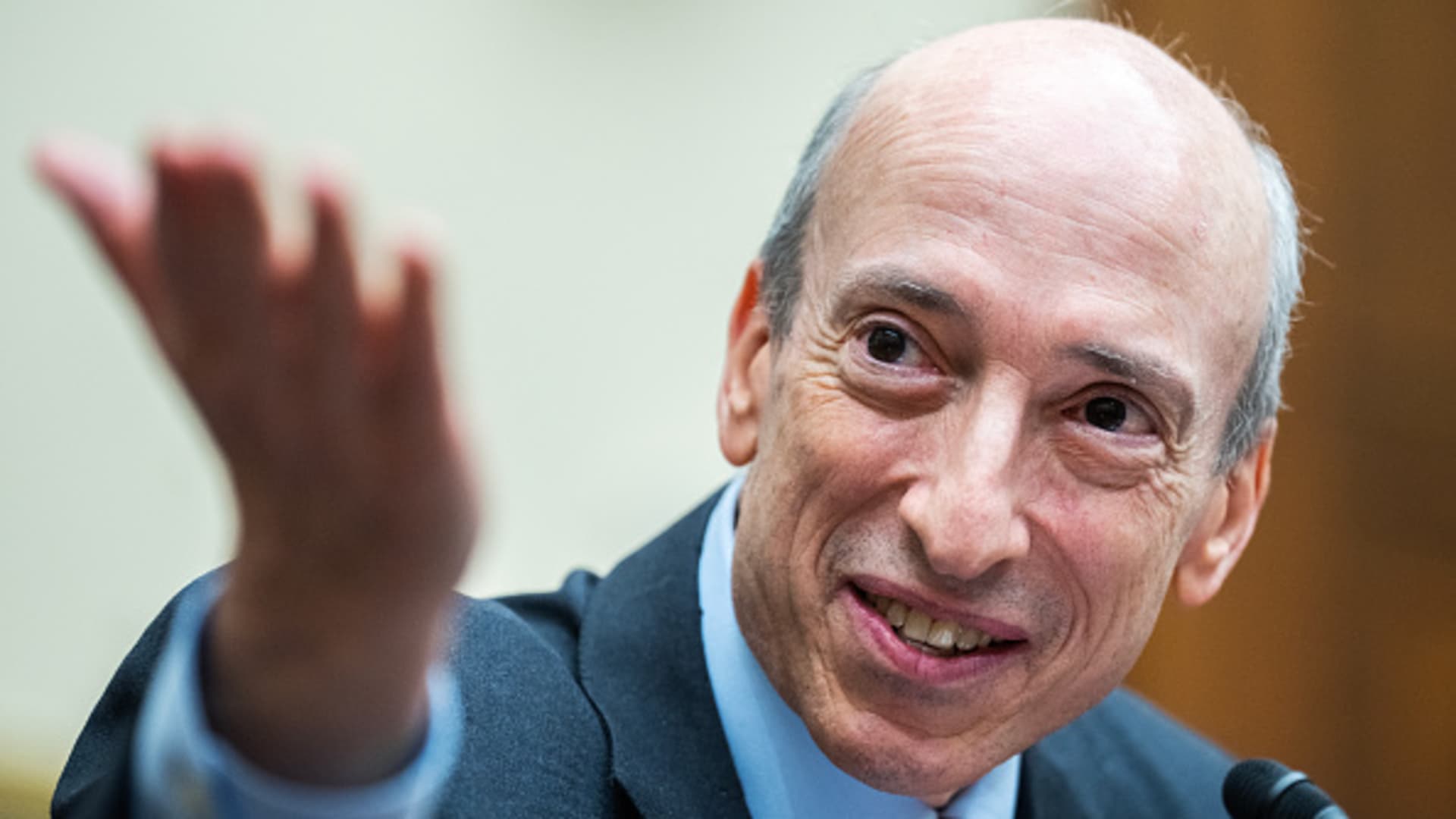

The Securities and Exchange Commission, led by Chair Gary Gensler, is set to vote on new rules aimed at reining in SPACs, or Special Purpose Acquisition Companies, which are formed to raise capital through an IPO for the purpose of acquiring or merging with another company. The proposed rules seek to enhance disclosure requirements, align legal liabilities for de-SPAC transactions with traditional IPOs, and eliminate "safe harbor" protection for forward-looking statements, in an effort to protect investors from potential fraud and conflicts of interest. Gensler has been critical of SPACs and their associated high fees, and the SEC acknowledges a decline in SPAC activity but emphasizes the need for investor protections regardless of market fluctuations.

- SEC to vote today on tough new rules for blank-check 'SPAC' companies CNBC

- SPAC Mania Is Dead. The SEC Wants to Keep It That Way. The Wall Street Journal

- SEC to Impose Tougher Rules on Blank-Check Deals Bloomberg

- U.S. SEC set to require more transparency from 'blank cheque' companies The Globe and Mail

- SEC to Impose Tougher Rules on Blank-Check Deals as SPACs Fizzle Insurance Journal

Reading Insights

0

6

3 min

vs 4 min read

85%

776 → 115 words

Want the full story? Read the original article

Read on CNBC