"Rising Consumer Credit: Record $5 Trillion and High Credit Card Rates"

TL;DR Summary

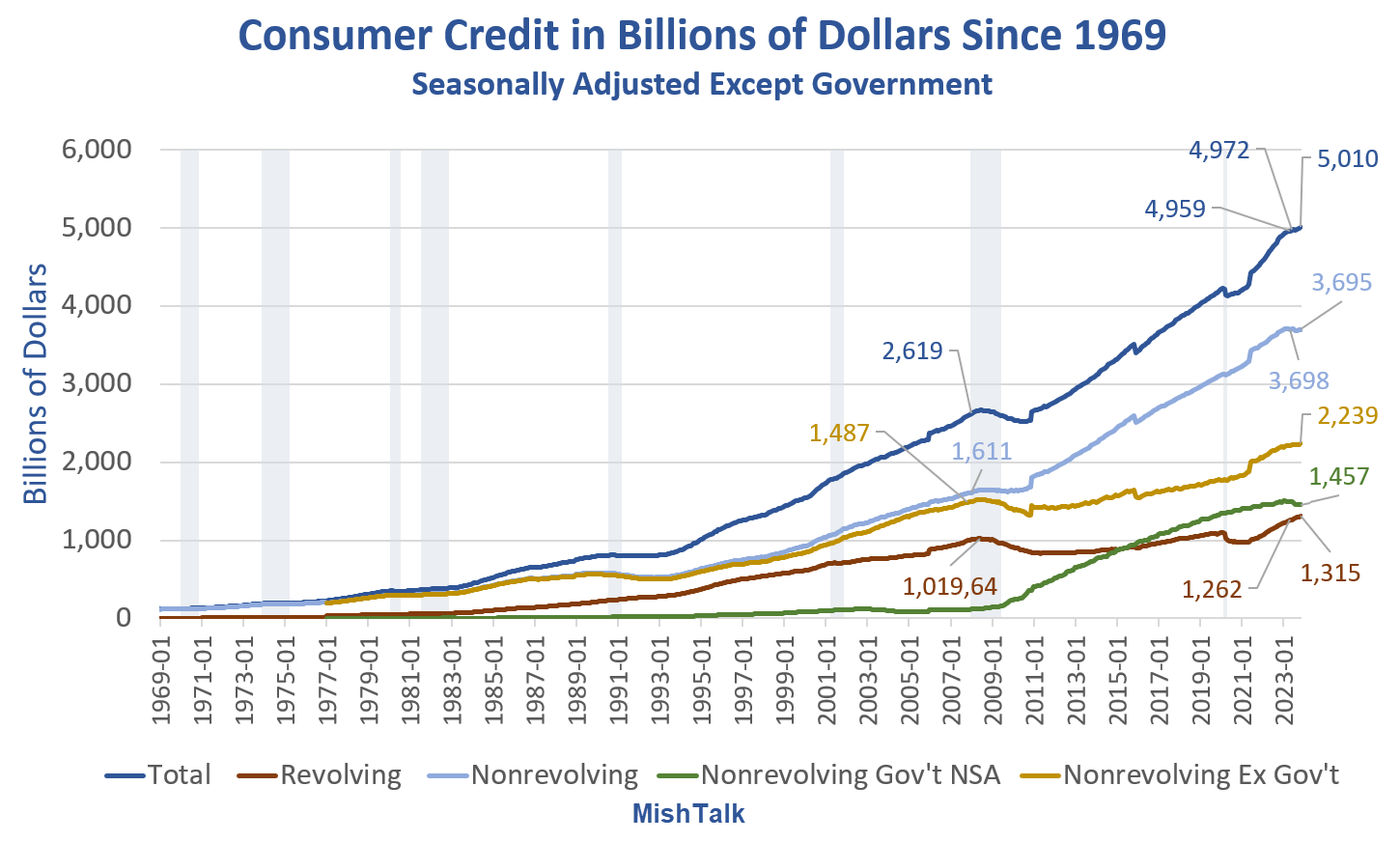

Consumer credit has reached a record $5 trillion, with revolving credit and credit card interest rates also hitting new highs in November. Adjusted for inflation, revolving credit is approaching levels seen during the Great Recession. Credit card rates, which averaged between 12-14 percent for most of 2000-2020, have now reached an average of 21.47 percent. Additionally, a spending deal has been reached, but the Republican Freedom Caucus has condemned it for not addressing border funding, potentially leading to further negotiations.

- Consumer Credit Hits Record $5 Trillion, Credit Card Rates Also Record High Mish Talk

- Charge it: Consumer debt just passed the $5 trillion mark Deseret News

- Survey: Nearly half of consumers carry credit card debt from month to month CBS Mornings

- US consumers feeling pain of higher rates, not Wall Street: economist Business Insider

- Credit card debt on the rise, but expert says help is available | KOMO KOMO News

Reading Insights

Total Reads

0

Unique Readers

7

Time Saved

1 min

vs 2 min read

Condensed

63%

215 → 80 words

Want the full story? Read the original article

Read on Mish Talk