Market Volatility Ahead: US CPI and Central Bank Decisions in Focus

TL;DR Summary

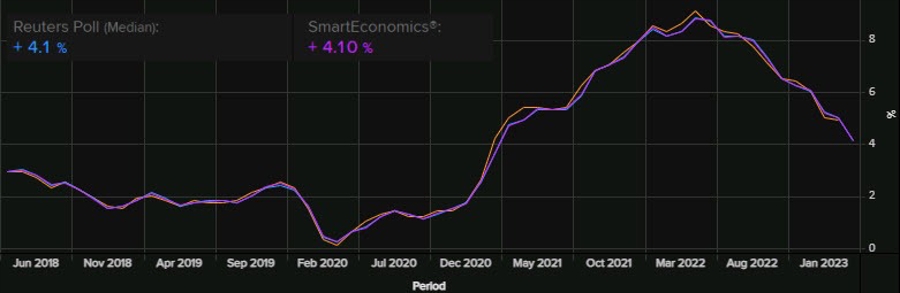

The US CPI figures for May, set to be released today, will be a key sticking point for markets to watch out for as continued strengthening in monthly consumer price inflation will eventually translate to more persistent price pressures down the road. The dollar, Treasury yields, and risk assets are all going to be intertwined as we get to the key risk event later today and the connection will stay in place all through the Fed policy decision tomorrow.

- US CPI the first key hurdle for markets this week ForexLive

- Europe stocks fall flat as investors gear up for central bank decisions; gilt yields surge on UK labor data CNBC

- Morning Bid: Markets in a spin ahead of interest rate decisions Reuters

- FOMC Preview: Will US CPI Upset the Apple Cart? DailyFX

- Brief European Central Bank, and CPI, previews via Deutsche Bank ForexLive

Reading Insights

Total Reads

0

Unique Readers

6

Time Saved

1 min

vs 2 min read

Condensed

74%

307 → 79 words

Want the full story? Read the original article

Read on ForexLive