"July 2024: Rates Remain Unmoved in Economic Downturn"

TL;DR Summary

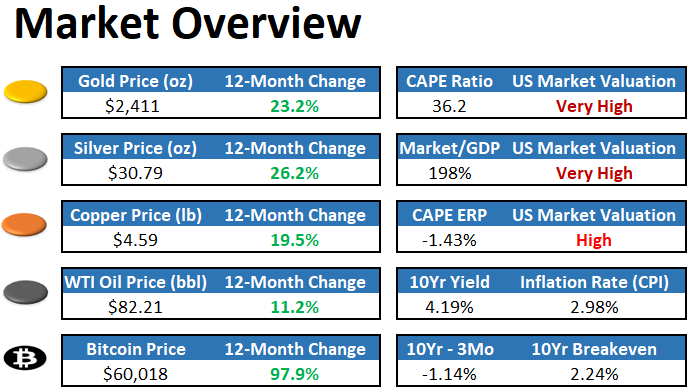

The U.S. economy is expected to be less sensitive to interest rate cuts in the next business cycle, similar to its insensitivity to rate hikes in the previous cycle. This fiscal dominance, characterized by large public debts and deficits, reduces the impact of monetary policy. As a result, the U.S. may experience economic malaise with limited stimulus from rate cuts, affecting investment strategies. Investors should consider a diversified portfolio with stocks, cash-equivalents, and commodities to navigate varying market conditions.

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

19 min

vs 20 min read

Condensed

98%

3,865 → 79 words

Want the full story? Read the original article

Read on Lyn Alden