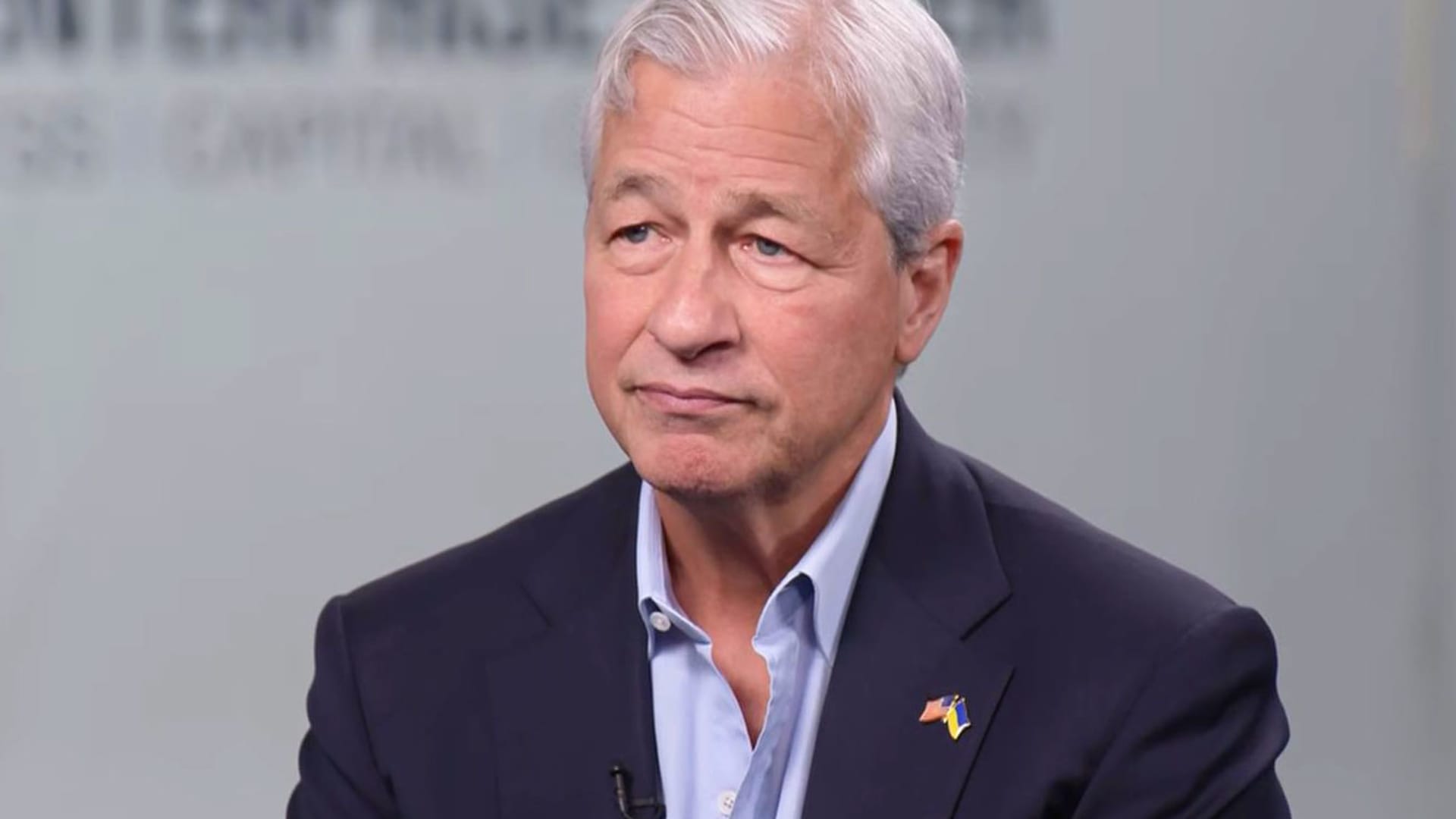

Jamie Dimon cautions on commercial real estate loans and advises preparation for higher rates.

TL;DR Summary

JP Morgan Chase CEO Jamie Dimon has warned that commercial real estate loans could pose a threat to some banks, particularly in certain locations and for certain types of properties. While U.S. banks have experienced historically low loan defaults in recent years, rising interest rates and changing work patterns could lead to defaults in the commercial real estate sector. Dimon also advised banks to prepare for interest rates to rise higher than expected, and to tighten lending activity to build capital and prepare for potential losses.

- Jamie Dimon warns that souring commercial real estate loans could threaten some banks CNBC

- JPMorgan's Dimon Says Be Prepared for Higher Rates Bloomberg Television

- JPMorgan's Dimon: 'Intensity is the same' after decades on top Yahoo Finance

- Banking on Dimon: The Bloomberg Close, Americas Edition Bloomberg

- Jamie Dimon turns tide of criticism over JPMorgan's big spending plans Financial Times

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

1 min

vs 2 min read

Condensed

73%

324 → 86 words

Want the full story? Read the original article

Read on CNBC