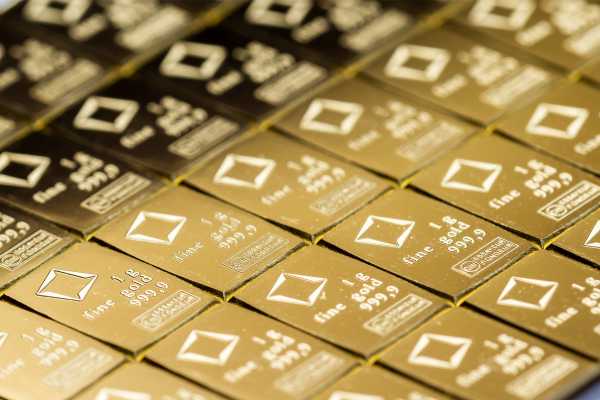

"Gold Prices Rise Amidst Inflation Data and Positive Forecasts"

TL;DR Summary

The gold market outlook for 2024 is influenced by the Federal Reserve's plan to cut interest rates, which will put upward pressure on gold prices. Economic and geopolitical risks, such as global economic slowdown and conflicts in the Middle East and Ukraine, also make gold an attractive asset for wealth protection. From a technical analysis perspective, the market is bullish, with attention on the $2000 level and the 50-Week EMA. The $1800 level is seen as a strong support level. Overall, while the value of gold may be affected by central banks cutting rates, it remains a reasonable asset for portfolio diversification.

- Gold Outlook for 2024 FX Empire

- Gold prices tick higher as investors await further U.S. inflation data CNBC

- Gold Price Forecast: No reason for any significant downward correction of XAU/USD – Commerzbank FXStreet

- Take Five: A golden 'everything' rally Reuters

- Gold, Silver, Platinum Forecasts – Gold Gains Ground At The Start Of The Week FX Empire

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

2 min

vs 3 min read

Condensed

83%

589 → 102 words

Want the full story? Read the original article

Read on FX Empire