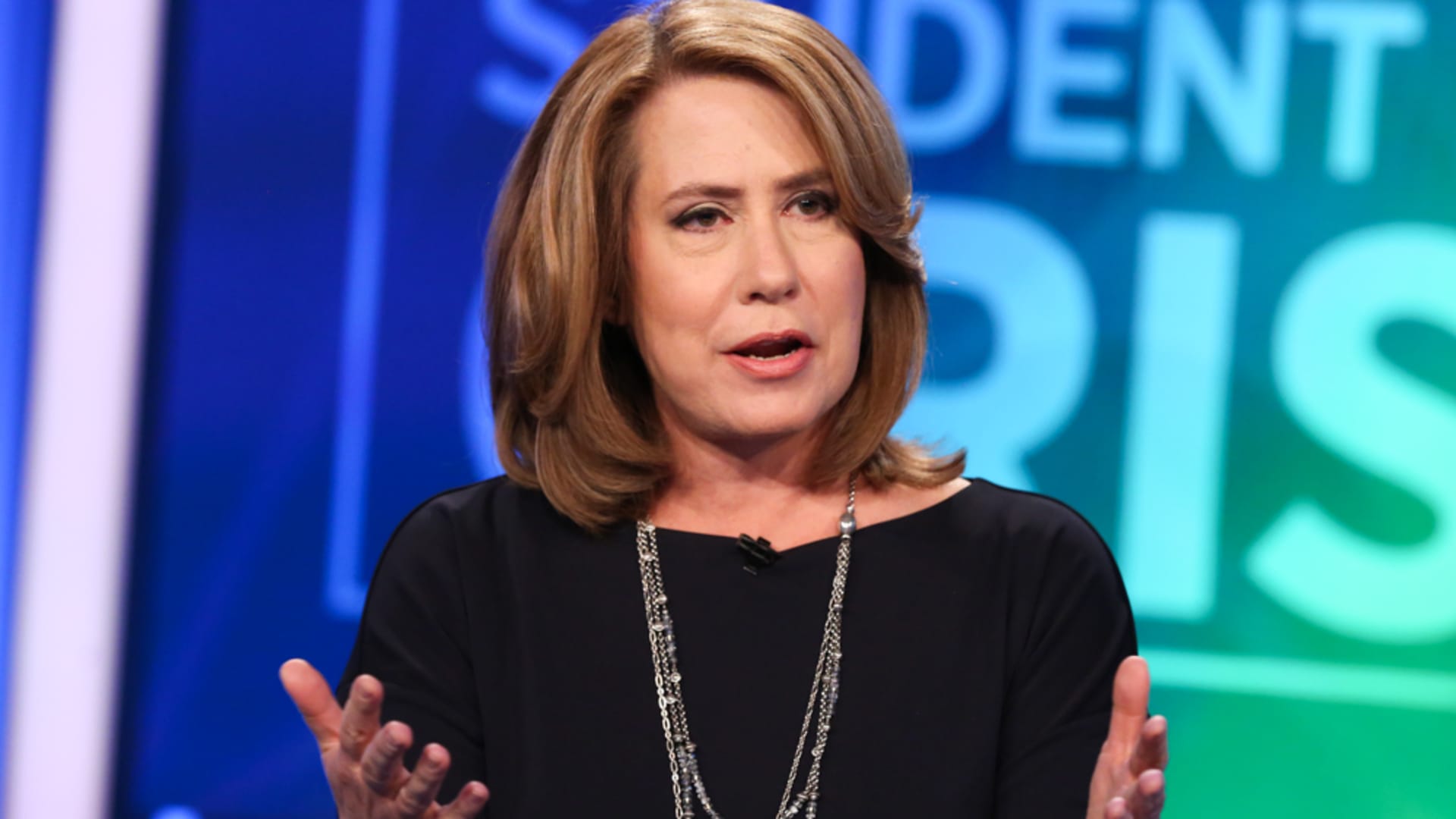

Former FDIC Chair Sheila Bair warns of irrational market optimism sparked by potential rate cuts by the Fed

Former FDIC Chair Sheila Bair warns that market optimism over potential interest rate cuts next year is dangerously overdone, suggesting that Federal Reserve Chair Jerome Powell's dovish stance at last week's policy meeting has created "irrational exuberance" among investors. Bair believes the focus should still be on inflation and worries that the Fed is pivoting towards recession concerns prematurely. Despite the Fed's expectation for at least three rate cuts next year, the market's bullish reaction is seen as temporary, and Bair cautions against significant rate reductions in 2024. She highlights sticky spots in prices for services and rental housing, as well as concerns about deficit spending, trade restrictions, and an aging population contributing to inflation pressures.

Reading Insights

0

4

1 min

vs 2 min read

60%

293 → 116 words

Want the full story? Read the original article

Read on CNBC