Fed's Emergency Lending to Banks Reaches Unprecedented Heights

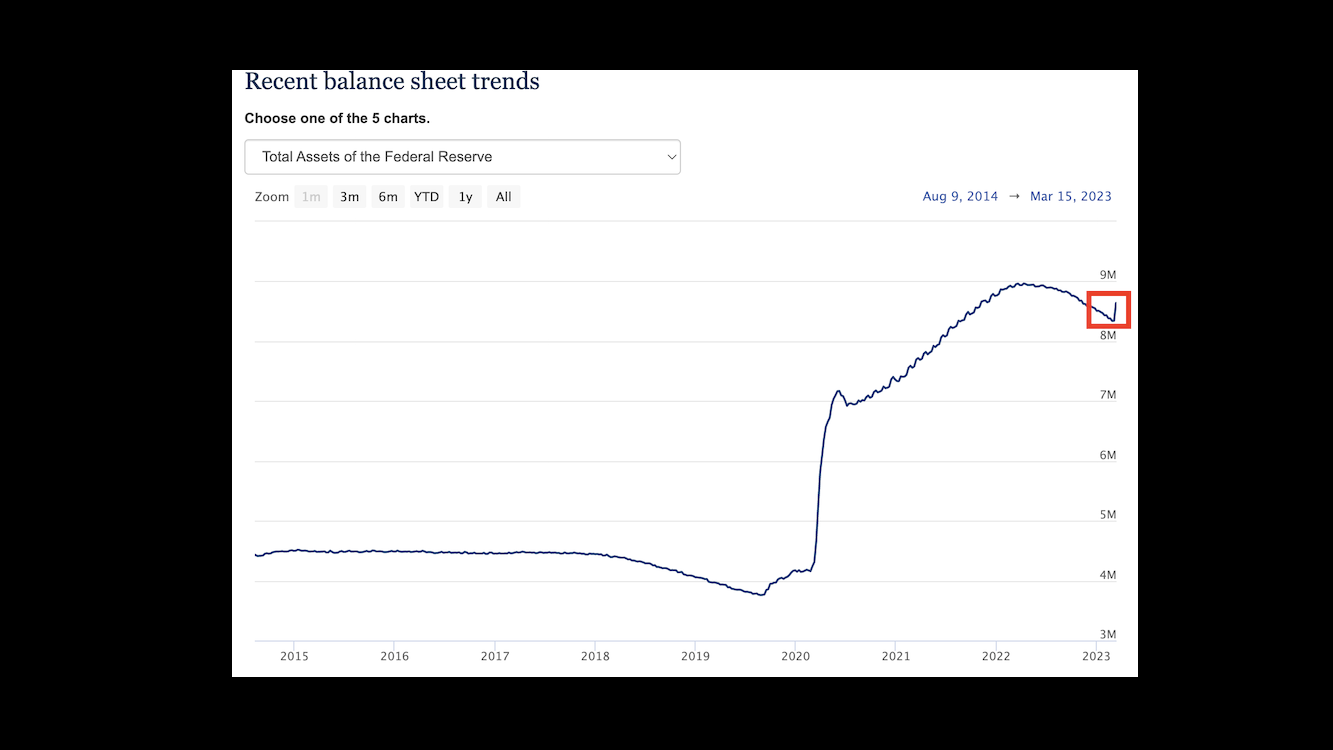

The Federal Reserve added nearly $300 billion to its balance sheet in a single week through its loan bailout program for banks, effectively loaning troubled banks $300 billion of new money that was created out of thin air. The Bank Term Funding Program (BTFP) will offer loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging US Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. The fact that banks borrowed $300 billion in just one week reveals just how unsound the US banking system is, and Americans will pay for these bank bailouts through the inflation tax.

- Fed Adds Nearly $300 Billion to Balance Sheet in One Week With Bank Bailouts SchiffGold

- The Fed’s ‘stress tests’ were supposed to save banks from the exact crisis now engulfing markets. Here’s how they were so spectacularly wrong Fortune

- Fed lent $300B in emergency funds to banks in the past week KTTC

- Fed Data: Most Emergency Lending Was in the West The Wall Street Journal

- Federal Lending to Banks This Week Eclipses 2008 Financial Crisis Peak Investopedia

Reading Insights

0

3

4 min

vs 5 min read

88%

920 → 111 words

Want the full story? Read the original article

Read on SchiffGold