FDIC and SVB Financial in Legal Battle over $2B in Frozen Funds.

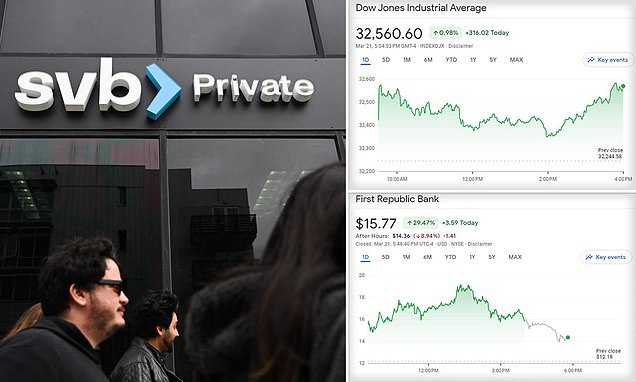

SVB Financial, the bankrupt parent company of Silicon Valley Bank, has accused the FDIC of improperly freezing $2bn in funds. The FDIC guaranteed the uninsured deposits at Silicon Valley Bank, including the cash deposits of the parent firm, but regulators froze SVB Financial's accounts as part of an ongoing investigation into potential claims against the parent company. Meanwhile, Wall Street CEOs and US officials are discussing the possibility of government backing to encourage potential buyers for battered First Republic Bank. The Dow Jones Industrial Average rose 316 points, or 1%, at the closing bell, after Treasury Secretary Janet Yellen said the government could offer the banking industry more assistance if needed.

- SVB Financial accuses FDIC of improperly freezing $2B in funds Daily Mail

- SVB's Big Bet on Troubled Private Bank Ends on the Auction Block Bloomberg

- Silicon Valley Bank's Financial TROUBLES ESCALATE: Clash over Cash Seizure Sparks Legal Battle | SVB WION

- SVB Financial clashes with FDIC over fate of $2bn in bankruptcy hearing Financial Times

- Silicon Valley Bank’s Former Parent Says FDIC Seized About $2 Billion of Its Cash The Wall Street Journal

- View Full Coverage on Google News

Reading Insights

0

6

4 min

vs 6 min read

89%

1,005 → 111 words

Want the full story? Read the original article

Read on Daily Mail