US Household Debt Reaches Record High Despite Slowdown in Mortgage Demand.

TL;DR Summary

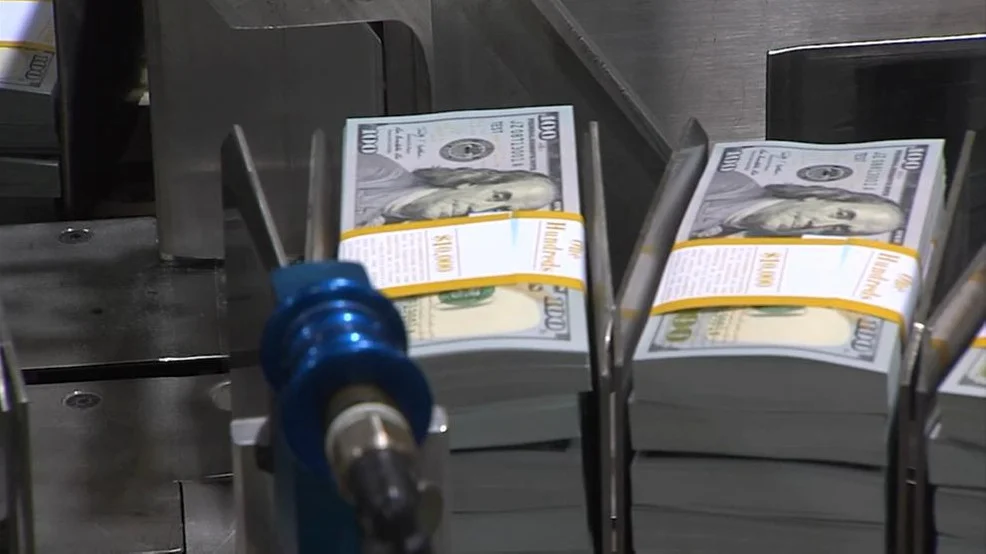

The Federal Reserve Bank of New York has reported that total household debt in the US has reached a new high of $14.56 trillion in the second quarter of 2020, driven by increases in mortgage, auto loan, and credit card debt. Despite a decrease in overall credit card balances, delinquency rates have increased, indicating financial stress for some households.

Topics:business#auto-loans#credit-cards#economy#federal-reserve-bank-of-new-york#household-debt#mortgages

- Total household debt reaches new high, Federal Reserve Bank of New York reports WLOS

- Consumer debt passes $17 trillion for the first time despite slide in mortgage demand CNBC

- New York Fed: Household debt rises by 0.9% in Q1, smallest gain in two years CNBC Television

- For first time ever, Americans carrying more than $17 trillion in debt WABC-TV

- Credit Card Payment Interest Rate: Balances Are Running High for US Consumers Bloomberg

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

0 min

vs 1 min read

Condensed

-556%

9 → 59 words

Want the full story? Read the original article

Read on WLOS