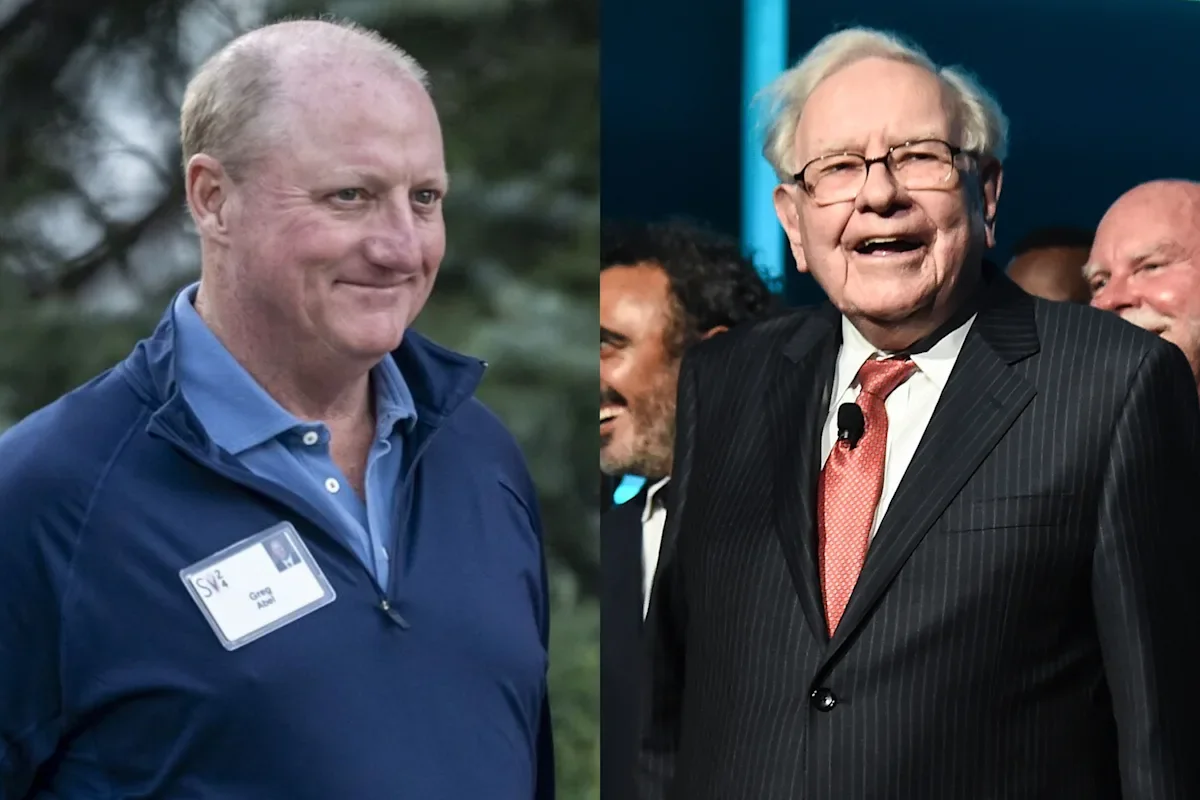

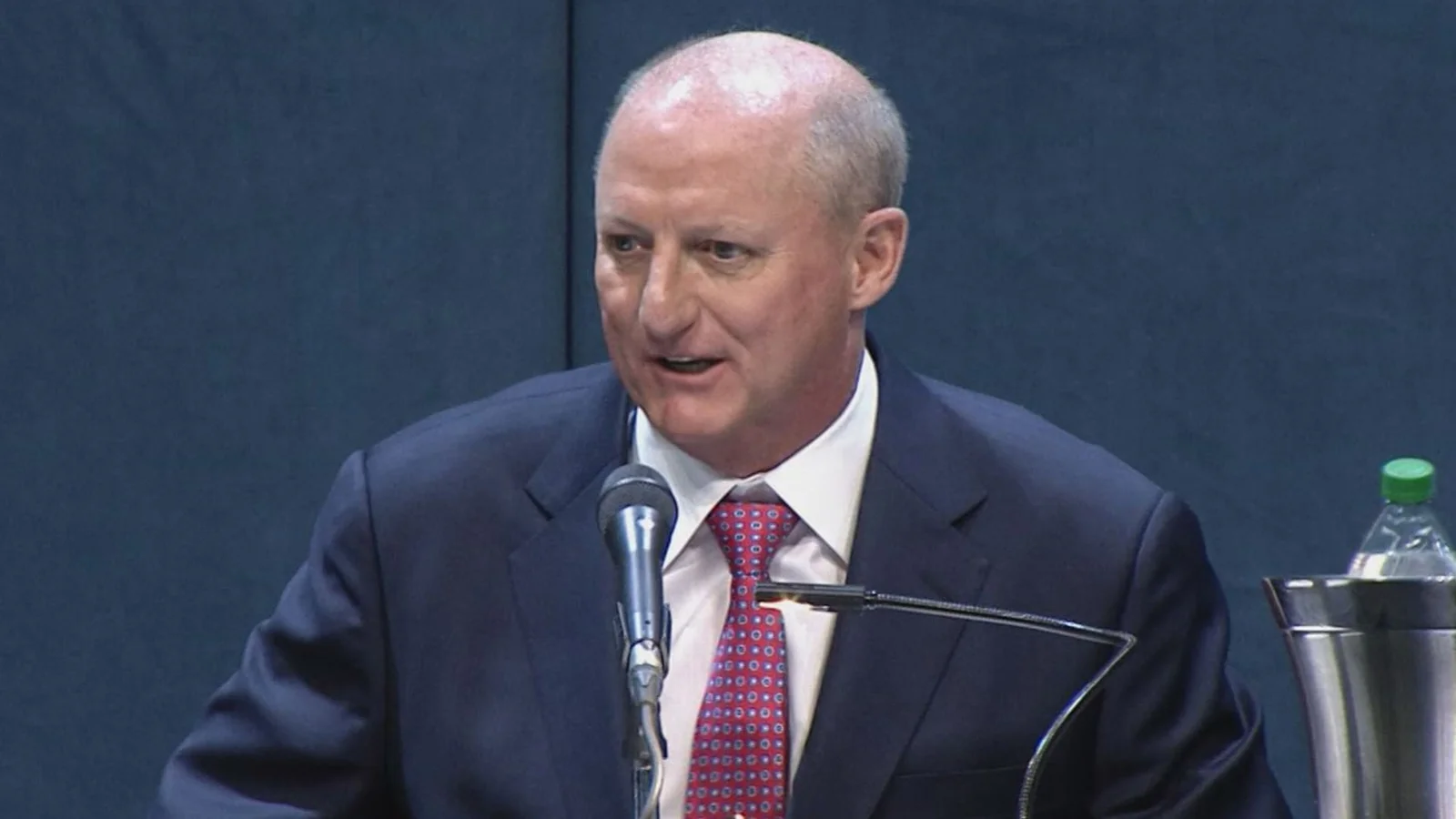

Abel vows Berkshire’s Buffett-era discipline endures

Greg Abel, in his first annual Berkshire letter as CEO, pledges to preserve Buffett’s disciplined investing and fortress balance sheet, maintains a no-dividend policy with ample cash as dry powder, and will run a concentrated equity portfolio (Ted Weschler manages about 6%) as part of a long-term, patient approach that eschews quarterly earnings cadence.