"Israel's Tower Plans $8 Billion Chip Plant in India, Boosting Semiconductor Program"

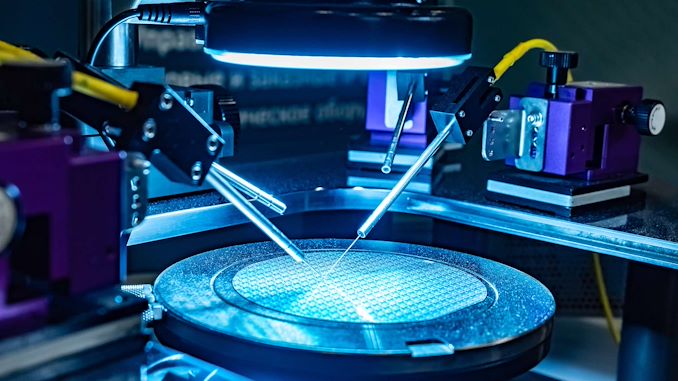

Israel's Tower Semiconductor has proposed an $8 billion investment to build a chipmaking facility in India, aiming to manufacture 65 nanometre and 40 nanometre chips in the country. The company is seeking government incentives for its plan, which aligns with India's focus on chip manufacturing as a key part of its business agenda.