Intel Abandons Tower Acquisition, Shifts Focus to Leading-Edge Nodes

TL;DR Summary

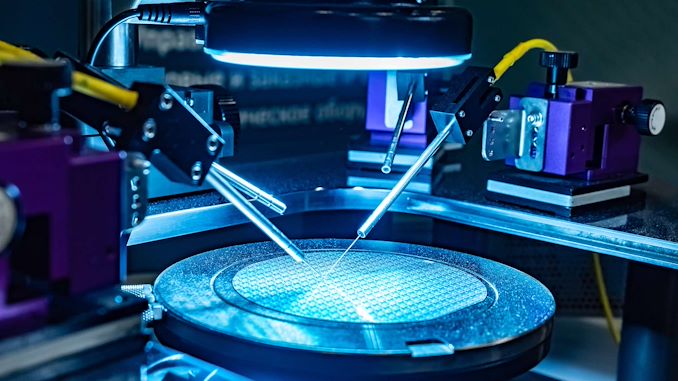

Intel has called off its $5.4 billion deal to acquire Tower Semiconductor due to a lack of regulatory approval from China. Instead, Intel will pay a $353 million break-up fee. This decision will force Intel to focus its Intel Foundry Services (IFS) division solely on leading-edge process technologies. Without Tower, IFS will need to compete directly with TSMC and Samsung Foundry using only a few nodes. Despite the challenges, Intel remains committed to becoming the world's second-largest foundry by 2030. The success of IFS will rely on pillars such as Intel's 16, 20A, 18A, and Intel 3 process technologies, as well as its advanced packaging capabilities.

Topics:business#chip-manufacturing#intel#intel-foundry-services#leading-edge-nodes#technology#tower-semiconductor

- Intel Calls Off Tower Acquisition, Forced to Focus Solely on Leading-Edge Nodes AnandTech

- Intel calls off $5.4 billion chip deal after failing to get regulatory approval CNN

- Intel terminates its acquisition of Israeli chipmaker Tower Semiconductor CNBC Television

- Intel's Scrapped Deal Shows Power of China Antitrust Regulators The Information

- Intel Can Succeed Without the Tower Semiconductor Acquisition The Motley Fool

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

4 min

vs 5 min read

Condensed

88%

870 → 106 words

Want the full story? Read the original article

Read on AnandTech