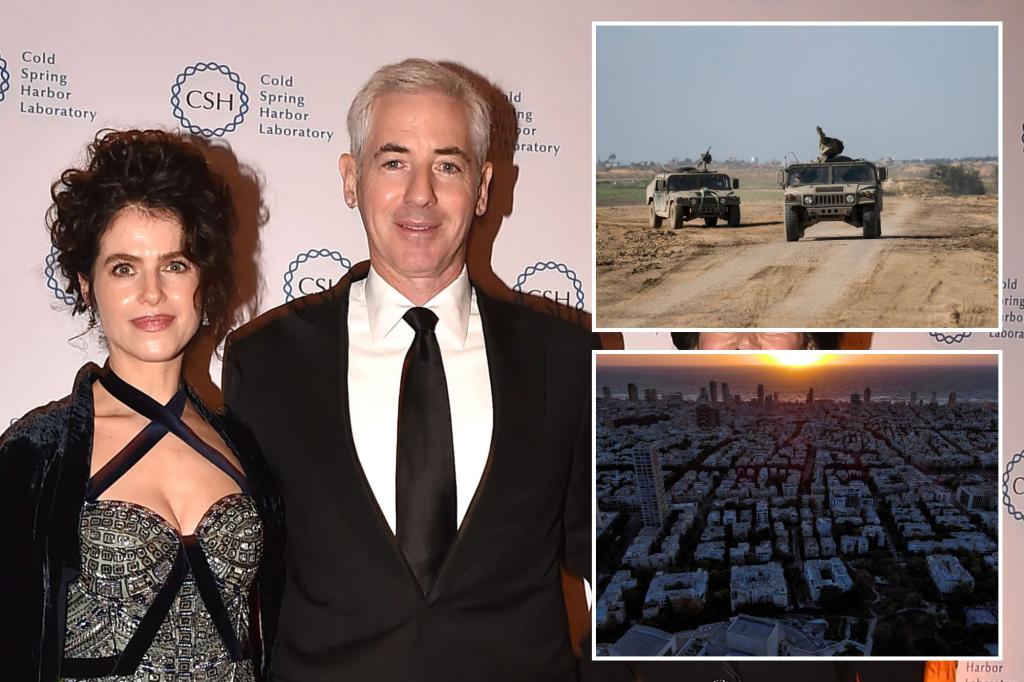

"Market Reaction: Tel Aviv Stocks Decline Amid Iran-Israel Tensions"

Amid escalating tensions between Israel and Iran, investors are closely monitoring the TA-35 Index, which tracks the 35 largest companies on the Tel Aviv Stock Exchange, as a barometer of Israel's economic pulse. Technical analysis suggests a potential 5-6% decline before a reversal area, with sectors like defense, energy, and technology under scrutiny. Historical examples illustrate the impact of Middle Eastern geopolitical tensions on global oil prices and economic stability, emphasizing the need for a comprehensive understanding of current events alongside technical analysis for informed investment decisions.