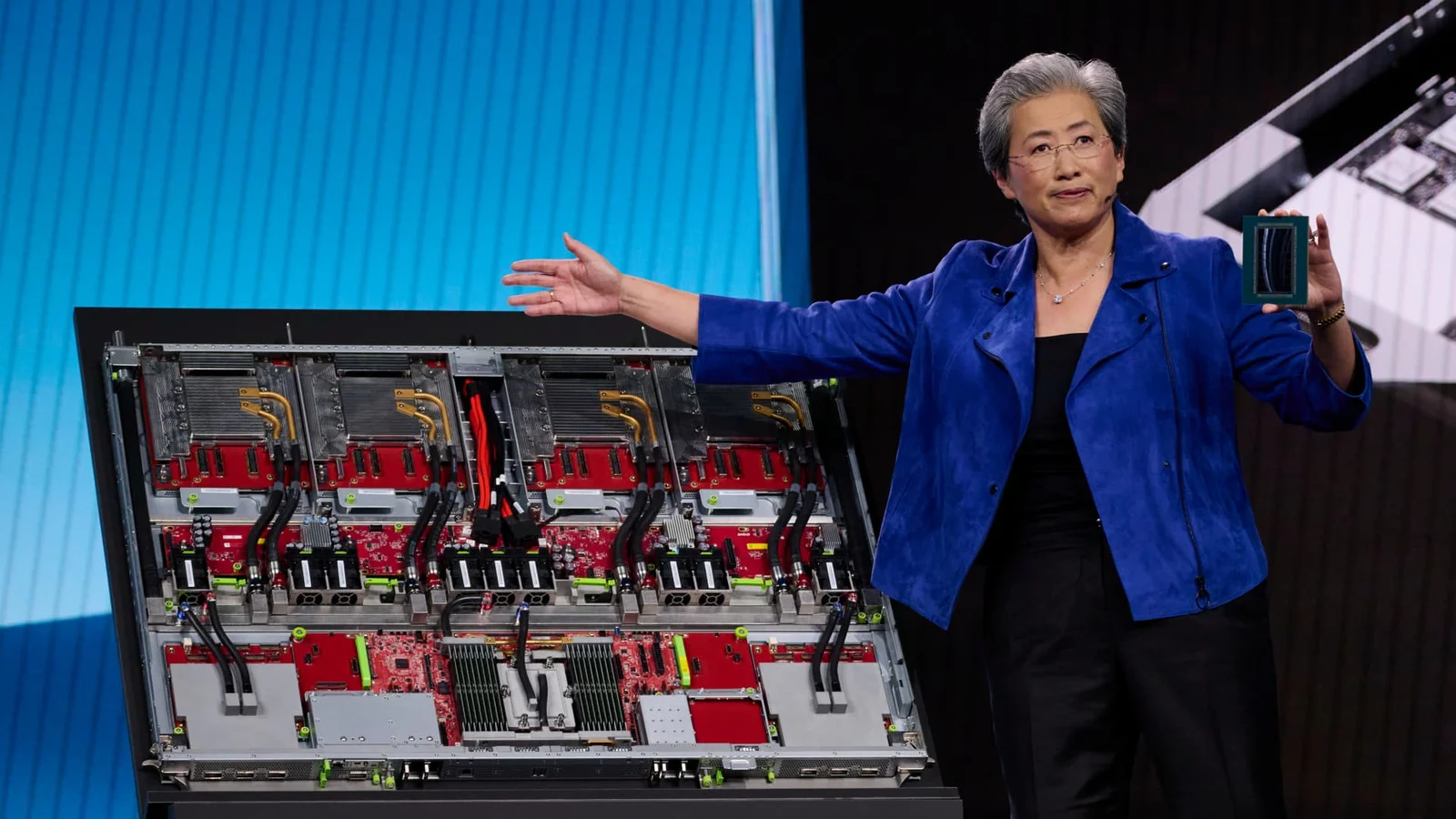

Kospi Leads Asia Sell-off as Tech Rout Deepens, AMD Drops on Weak Outlook

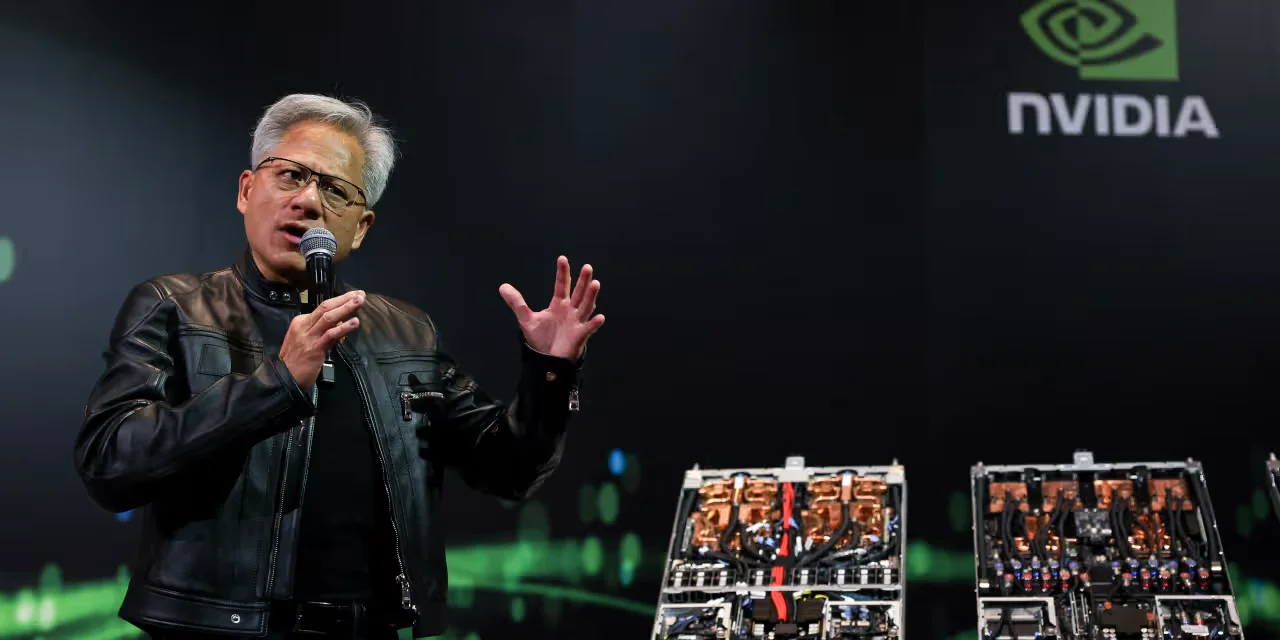

South Korea's Kospi slid about 3.9% to 5,163.57, led by Samsung and SK Hynix as a broad tech sell-off hit Asia; Arm/SoftBank results miss and a weak first-quarter forecast from AMD weighed on sentiment, with other chipmakers and tech names falling, while Japan's Nikkei eased and Hong Kong/China markets declined. Bitcoin also fell as global risk appetite remained fragile.