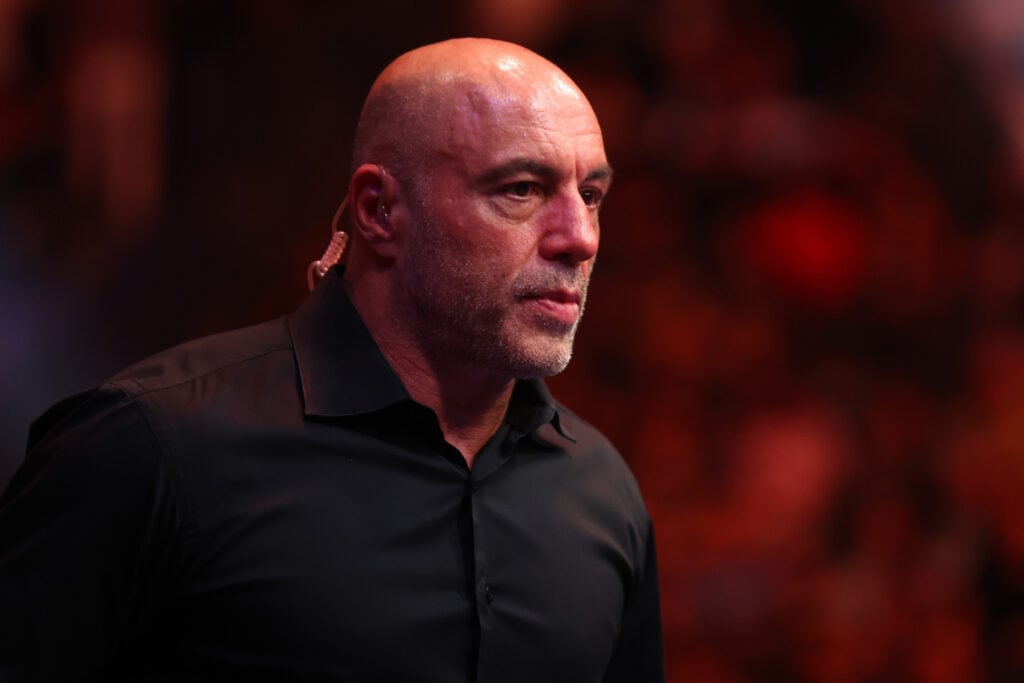

Joe Rogan Praises Billionaires' Hard Work and Advocates for Wealth Sharing

Joe Rogan defends billionaires, highlighting their hard work and the necessity of tax loopholes, while acknowledging the inequality and suggesting wealth sharing could reduce public resentment, amidst a discussion with Tom Segura on wealth, taxes, and societal disparities.