"SoFi's Volatile Journey: Is Rapid Growth Worth the Investment Risk?"

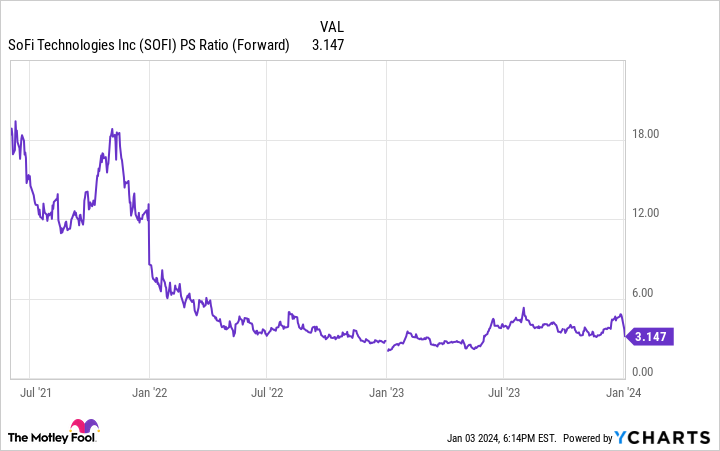

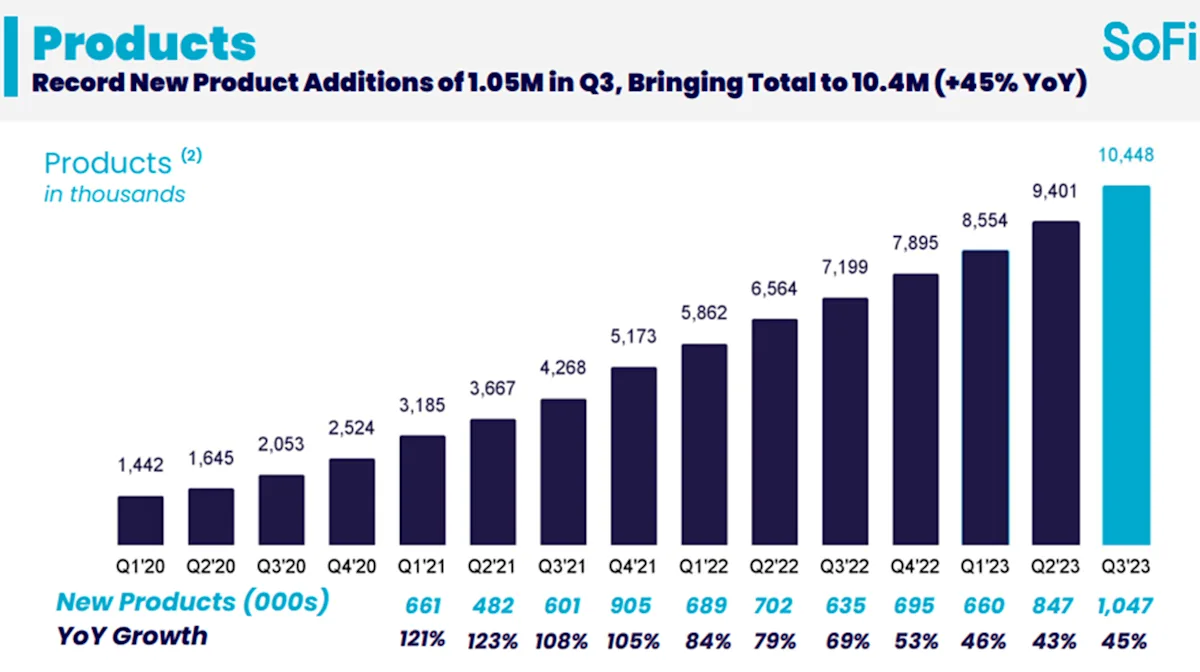

SoFi Technologies (NASDAQ: SOFI) is highlighted as an ultimate growth stock to consider buying with $500, due to its strong performance in a growing fintech industry, effective management, and competitive edge with a user-friendly digital platform. Despite the economic pressures, SoFi has shown significant growth, with a 27% year-over-year revenue increase and a 47% increase in member signups. The company is still reporting net losses but shows promising signs with increased adjusted EBITDA and profitability in all business segments. SoFi's stock soared by 125% in 2023, and with the expectation of net profit in Q4 2023, it is suggested as a valuable investment for potential long-term gains.