"SoFi's Stock Volatility: A Bearish Trend or a Chance to Buy?"

TL;DR Summary

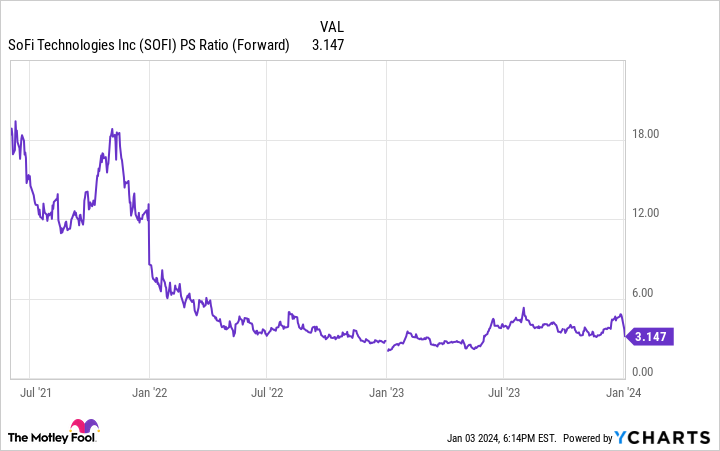

SoFi Technologies' stock experienced a significant drop after an analyst downgraded the company's rating and lowered the price target. Despite SoFi's revenue growth and member base expansion, its long-term earnings potential remains uncertain, leading to a speculative valuation. The stock trades at a low price-to-sales ratio but a high forward price-to-earnings ratio, making it potentially attractive to risk-tolerant investors. However, it may not be suitable for those averse to volatility. The Motley Fool's Stock Advisor service did not include SoFi in its top 10 recommended stocks, suggesting there may be better investment opportunities available.

Topics:business##analystdowngrade#finance-and-investments#fintech#investmentopportunity#sofitechnologies#stockmarket

- SoFi Stock Fell Today -- Is This a Buying Opportunity for 2024? Yahoo Finance

- Analyst Downgrade Sparks SoFi (NASDAQ:SOFI) Slide - TipRanks.com TipRanks

- SoFi's Looking Pretty Soft - TheStreet's Real Money Pro RealMoney

- SoFi Stock Tumbles on Downgrade. Lower Rates Might Not Be a Good Thing. Barron's

- SoFi's stock could follow record year with a sharp plunge, this new bear warns MarketWatch

Reading Insights

Total Reads

0

Unique Readers

9

Time Saved

2 min

vs 3 min read

Condensed

80%

477 → 94 words

Want the full story? Read the original article

Read on Yahoo Finance