"SoFi's Stock Volatility: A Bearish Trend or a Chance to Buy?"

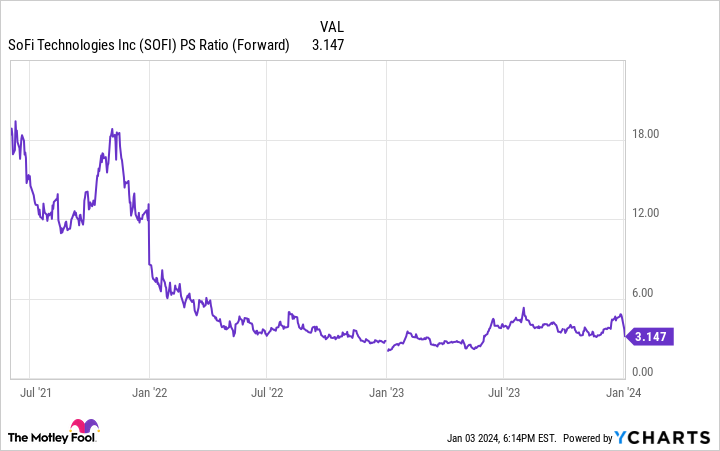

SoFi Technologies' stock experienced a significant drop after an analyst downgraded the company's rating and lowered the price target. Despite SoFi's revenue growth and member base expansion, its long-term earnings potential remains uncertain, leading to a speculative valuation. The stock trades at a low price-to-sales ratio but a high forward price-to-earnings ratio, making it potentially attractive to risk-tolerant investors. However, it may not be suitable for those averse to volatility. The Motley Fool's Stock Advisor service did not include SoFi in its top 10 recommended stocks, suggesting there may be better investment opportunities available.